On March 23rd, 2022, QuickSwap’s community voted in favor of a 1:1000 token split. This means that QUICK’s supply will increase from a 1 million max supply to a 1 billion max supply. Read more about how this token split will affect you below.

TL; DR:

- On March 17th, 93.19% of QUICK and dQUICK holders voted for a token split to make QUICK more appealing

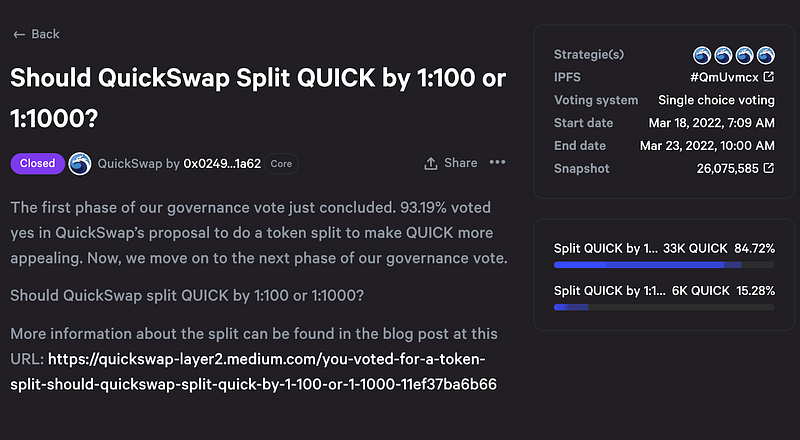

- As of today, 84.72% voted in favor of a 1:1000 Token Split

- This means that QUICK’s max supply will increase from 1 million to 1 billion

- For every 1 QUICK a holder has before converting, he or she will hold 1 thousand QUICK after going through the conversion contract

- This change to our tokenomics will impact all QUICK and dQUICK holders in a number of ways:

- Increasing QUICK’s maximum supply will reduce the asset’s price per unit, making it more appealing to crypto enthusiasts who compare QUICK to other DEX tokens without considering supply

- All QUICK holders will need to convert their QUICK v1 into QUICK v2 via our conversion contract, which is currently under audit

- Nothing will happen overnight or automatically

- For now, there is nothing to be done. QuickSwap LPs, QUICK stakers, and QUICK holders should continue to do exactly what they are doing now until further notice

- QuickSwap will provide more details about the conversion contract, audit, and how you can convert your QUICK as soon as possible

Dragons are wild beasts

When we first opened our governance temperature check on March 1st to talk through this proposed change and gauge the community’s sentiments, we were surprised at the level of opposition to the proposal. Many were concerned that QuickSwap was focusing on the wrong things and that the team should focus more on development and less on supply. Others worried that the team was pushing the proposal hastily and without having done adequate research on the relationship between price and supply or the history of token splits in crypto. After several days of discussion with QuickSwap’s leadership team demonstrating their competency, much of the community began to understand why the QuickSwap team felt as though a token split was necessary.

With the community now behind the split, we moved to vote. We asked all eligible QUICK holders if QuickSwap should do a token split to make QUICK more appealing. On Thursday, March 17th, that vote concluded with 93.19% of voters in favor of the split. We then asked QUICK holders which denomination they would prefer: 1:100 or 1:1000? Today, we’re thrilled to report that 84.72% voted for the 1:1000 redenomination. In total, 39,000 QUICK from 435 wallets participated in this vote. Of the 39 thousand total QUICK, 33 thousand QUICK from 335 wallets (~77%) voted in favor of a 1:1000 token split. Of the 435 total votes, only 100 (~23%) voted in favor of the 1:100 option.

Now that the token split vote has concluded, Sameep and QuickSwap’s development team have finalized the code for our converter contract and submitted it to external auditing firms. When the audits are complete, we will provide more details about how to convert your QUICK (v1) to QUICK (v2) via our conversion contracts and who needs to do it.

What does this mean for me?

We believe this change to QUICK’s tokenomics will positively impact all QUICK and dQUICK holders in the long term. By increasing QUICK’s total supply from 1 million tokens to 1 billion tokens, we are bringing QUICK more inline with other DEX tokens whose mode maximum supply is 1 billion.

This means that the price per unit of each individual QUICK token will decrease to 1/1000th of what it’s valued at at the time of the split; however, each QUICK holder will have 1000x the supply they held before the split after it, retaining the same dollar value.

For example:

Let’s say that Ritzy owns 100 QUICK today and he retains that 100 QUICK until the conversion contract is live. He then converts his QUICK v1 to QUICK v2. After conversion, Ritzy would own 100,000 QUICK (v2), but they would be worth the same amount that 100 QUICK was worth before converting. At the time of writing, 1 QUICK was worth $228.44, which means that 100 QUICK was worth $22,844. If QUICK’s value remains unchanged, after converting 100,000 QUICK v2 would be worth $22,844, and 1 QUICK v2 would be worth ~$0.23.

As one of QuickSwap’s valued ambassadors Prynxx put it, the QUICK token split will increase the value and market cap of the token because people prefer to buy 1000 units rather than 1 of anything!

Of course, there’s no guarantee that QUICK’s market cap will rise with the lower price per unit, but the possibility for an increase does exist, and there is precedence to support the position that unit bias affects consumers. In fact, in the last two weeks, QUICK’s price has already risen by over 45% (from a low of $156.13 on March 9th to a high of $226.92 earlier today). That could very well be because the market views their purchase as 1000x the number of QUICK they see on their screens, and they know that a higher unit count will result in more buyers being attracted to QUICK. We want more community members because a project’s strength depends on the strength of its community, and we want ours to grow!

Alright, but what about me, specifically?

While we’re confident that this change will positively impact all QUICK holders, we also want to assure that our community members understand exactly how this token split will impact them. Below, we will walk through specific examples of what this will mean for QUICK and dQUICK holders.

Please be aware that our conversion contract is not yet audited. No one will do anything until the contract clears the audit. QuickSwap will inform the community of how to use the conversion contract as soon as it’s cleared.

Example 1: Roc is providing liquidity for an incentivized dual mining pool and wants to continue earning $dQUICK and $MATIC rewards PLUS a portion of the pool’s trading fees

Roc is a liquidity provider for the MATIC-QUICK dual farming rewards pool. He provides one quarter of the pool’s ~$6.6 million liquidity ($1.65 million), so he earns one quarter of the pool’s 16 QUICK (11.32 dQUICK) per day and one quarter of the pool’s 100 MATIC per day. Roc uses the 4 QUICK and 25 MATIC he earns each day to add to his liquidity position to earn more dQUICK and MATIC.

When the conversion contract goes live, Roc will need to withdraw his LP tokens, then he’ll need to withdraw his liquidity. Next, Roc will need to deposit his ~3,611.45 QUICK (v1) in QuickSwap’s conversion contract. On the other side of the conversion, Roc will receive ~3,611,450 QUICK (v2). To continue earning rewards, Roc will then take his ~3.6 million QUICK v2 and MATIC, deposit it again under Pools, then deposit his LP tokens under Farm > Dual Mining.

Note: This process is the same for all liquidity providers regardless of whether they LP for a dual mining pool, single LP mining pool, or even an unincentivized pool.

Example 2: Sameep stakes QUICK in the Dragon’s Lair to earn more QUICK and wants to continue staking to generate passive income

Sameep is somewhat risk averse and prefers to use QuickSwap’s single-asset staking mechanism to generate more QUICK than risk impermanent loss by providing liquidity.

When the conversion contract goes live, Sameep will need to withdraw his QUICK v1 from the Dragon’s Lair and deposit it into the conversion contract. When Sameep receives his QUICK v2 on the other side of the contract, he will then redeposit his QUICK into the new version of the Dragon’s Lair (more details about this will be released as soon as possible).

Example 3: Muraj stakes QUICK in a Dragon’s Syrup Pool and wants to continue earning that token as a reward

Option 1 -

Muraj stakes QUICK in the new IXT syrup pool. He wants to continue earning IXT. The IXT pool doesn’t expire until August 20th, 2022, and Muraj wants to continue earning IXT until then.

Muraj doesn’t have to do anything. Existing Dragon’s Syrup Pools will continue to pay out to stakers who deposit QUICK v1. When the IXT pool expires, Muraj will need to withdraw his QUICK from the pool and deposit it into the conversion contract. On the other side of the conversion, he will take his QUICK v2 and choose between staking it in the Dragon’s Lair to earn more QUICK v2 or staking it in a new Syrup Pool to earn that token as a reward.

Option 2 -

Muraj stakes QUICK in the TEL syrup pool, which expires on June 1st, 2022. Muraj likes TEL (I mean, what’s not to like?), but he wants to start earning a token that is only available to QUICK v2 stakers.

When the conversion contract goes live, Muraj will need to withdraw his QUICK v1 from the Syrup Pool and deposit it into the conversion contract. When Muraj receives his QUICK v2 on the other side of the contract, he will then deposit it into the new syrup pool to earn that token as a reward.

Example 4: Maxim holds liquid QUICK in a self-custodial wallet on the Polygon network

Maxim is new to DeFi. He’s ventured onto Polygon to avoid the high-gas fees on Ethereum’s Mainchain, but he isn’t familiar enough with protocols to feel comfortable providing liquidity or staking just yet.

Maxim should educate himself immediately! There’s no excuse for not earning passive income when it’s so easy to do (kidding, but not really)! After learning about how easy it is to stake QUICK on our native platform, Maxim decides he’s ready, but he has only 10 QUICK v1, so the current 22.5% APY that Dragon’s Lair stakers earn will only equate to a gain of about 2.25 QUICK in a year. That doesn’t sound like very much. Maxim prefers the math he gets when he uses the QUICK v2 numbers.

When the conversion contract goes live, Maxim will deposit his 10 QUICK v1 into the contract and receive 10,000 QUICK v2 on the other side. He will then deposit his 10,000 QUICK v2 in the Dragon’s Lair v2, where he will earn 2,250 QUICK v2 per year (if the Dragon’s Lair v2 APY is the same as the current APY in the Dragon’s Lair v1).

Example 5: Aamir holds liquid QUICK in a self-custodial wallet on the Ethereum Network

Aamir is a major QUICK whale who holds his QUICK on Ethereum because he isn’t concerned about high gas fees. Aamir holds 10,000 QUICK v1 (1% of QUICK v1’s total supply). When Aamir learns that QuickSwap is doing a 1:1000 token split, he gets excited! This means that after converting, he will own 10 million QUICK v2 (still 1% of QUICK’s total supply, but 10 million just sounds better than 10 thousand, doncha think?).

When the conversion contract goes live, Aamir will need to bridge his QUICK v1 to the Polygon Network before he can convert it to QUICK v2. Once it is bridged, Aamir will deposit his QUICK v1 into the conversion contract and receive QUICK v2 on the other side. What he does with his QUICK v2 is then up to him.

Example 6: Seth holds QUICK on a centralized exchange (like Binance or Coinbase). He doesn’t hold his own private keys and is alright with that

Seth is a trader. He bought QUICK as a speculative investment when it listed on major CEXs in July 2021 and has been holding it ever since (wah, wah). Seth doesn’t care about what he can do with his QUICK because he’s just after a QUICK turn-and-burn profit (pun intended).

Seth should encourage the exchange where he holds the token to support the token split QuickSwap’s team is working on this as well. Based on precedence set by other tokens, centralized exchanges are likely to support the new token in time; however, it may be several months before token holders see their balances change. If/when a CEX supports the token split, they will automatically convert the token for exchange holders. People like Seth don’t really need to do anything!

What’s next?

All of this change is really exciting, but we want to take a moment to remind QUICK holders that this split will not happen overnight. First, our auditors need to diligently review our token conversion contract code to ensure there are no security vulnerabilities. Once that is complete, QuickSwap will begin encouraging token holders to convert their QUICK v1 and LP, stake, or HODL QUICK v2 instead. We will provide more details about how the conversion contract works as soon as we possibly can!

Additionally, this community decision means that we are now almost ready to introduce a discussion about the next phase of our plan to make QuickSwap a fully decentralized DAO, controlled entirely by our community. We don’t want to give away too much just yet, but it may or may not include a discussion about introducing a veToken model.

Let us know if you have any additional questions about how the token split will work in the comments below, and join us on social media to stay up-to-date on all things QuickSwap — Polygon’s most established DEX.

Twitter | Telegram | Announcements | Medium | Discord | Reddit

By QuickSwap Official on March 23, 2022.

Exported from Medium on May 2, 2023.