Armadillo is offering optional insurance to protect QuickSwap liquidity providers (LPs) from Impermanent Loss (IL). As a special promotion, Armadillo is allowing QuickSwap’s LPs to try it for free for up to $1k and offering a 10% discount on the total value for those who want to try it out for larger LP positions.

TL; DR

- Liquidity providers risk IL when they provide liquidity for a DEX

- Meanwhile, DEX users rely on LPs to trade their favorite assets

- CVI offers Armadillo insurance to protect LPs from IL

- QuickSwap is making this product available to LPs who want to try it out

- Armadillo will provide up to $1k in free protection and a 10% discount after that, along with a free NFT for QuickSwap’s users who opt in

- This promotional offer is available for 1 month, from today, September 21, 2022 — October 21, 2022

- This insurance is available only for select pairs on V2

- The Armadillo team is developing models for V3 and plans to add them in the near future

- Read more about it below, then join the Twitter Spaces today (9/21) at 15:00 UTC (8 am PDT) to ask the team anything you what to know

- Please note QuickSwap does not manage or endorse this product. We always encourage users to do their own research and take responsibility for their financial decisions

What’s This?

In volatile market conditions, liquidity providers face an increased risk of impermanent loss. Sometimes this results in lower liquidity on DEXs and higher slippage for DEX users. That’s why CVI built an index to offer Armadillo Insurance to allow liquidity providers to protect themselves against IL.

QuickSwap is the first DEX that CVI chose to collaborate with to offer Armadillo Insurance. To celebrate, CVI will allow QuickSwap’s LPs to try their product for free for up to $1k in liquidity. Users who want to insure larger LP positions can opt in for a 10% discount.

Included pairs

Naturally, Armadillo Insurance can only offer IL protection for select pairs. These pairs include

- wBTC-ETH

- wBTC-USDC

- wBTC-USDT

- wBTC-DAI

- ETH-MATIC

- MATIC-USDC

- MATIC-DAI

- MATIC-USDT

- LINK-ETH

- LINK-USDC

- LINK-USDT

- LINK-DAI

- BNB-DAI

- BNB-USDT

More pairs may be added in time, depending on demand and volatility.

FREE? How do I sign up?

The Protector Gold package is completely free. It’s available to all QuickSwap LP token holders (liquidity providers). Those who mint this NFT will have access to a 10% discount on Armadillo IL protection premium. The free coverage and discount will be available for 1 month, until October 21st, 2022.

The free $1k of protected liquidity represents the combined value of both assets in the pool.

For example, Let’s take the wBTC-ETH pool. To LP $1k, you would provide $500 in wBTC and $500 in ETH. To qualify for Armadillo’s free IL protection insurance, follow these simple steps:

- Provide liquidity

- Click this link

- Connect your wallet

- Armadillo’s system will recognise if you’ve LPd, or if you hold LP tokens

- That’s it!

10% Discount for larger positions

This product will likely be more appealing for LPs who have more to lose. Those who want to try out Armadillo Insurance for larger LP positions will get a 10% discount on the total value of the premium they buy in any QuickSwap pool.

The Protector Diamond package is for QuickSwap LPs who provide over $1k of liquidity. The first $1k is protected for free, and a 10% discount on Armadillo’s IL protection premium is offered for all values above $1k. The promotion and discount will be available for 1 month, until October 21st, 2022.

For instance: If you want to purchase IL protection for $10k liquidity in the ETH-USDT pool, Armadillo would protect $1k for free. They would cover the remaining $9k premium at a 10% discount.

The promotion will run for 1 month, starts at 21th of September until 21th of October.

How much does the insurance cost?

The amount of the premium depends on several factors

- The pair

- The time period of the protection

- The CVI index

- The liquidity pool ratio

- The coverage costs roughly between 0.3%-2.5% of the protected amount

To further explain, when the “seller” liquidity pool is getting utilised more, the premium rises.

Let’s use the $10k ETH-USDT example from above, $1k protection would be free. Coverage for the remaining $9k would cost between $27-$225.

What % Does Armadillo Insurance Cover?

CVI’s Armadillo Insurance covers 100% of the Impermanent Loss experienced with no claim needed on changes of up to 15% IL.

It covers every instance where one asset drops 70%+ or raises 230%+ in one month, which covers 99.6% of historical data.

Why Only V2?

Armadillo’s IL protection insurance relies on a complex algorithm and smart contract that is based on V2 DEX models. The CVI development team intends to fit their models to V3. They are currently developing those models and hope to offer Armadillo IL Protection insurance for V3 LPs very soon.

About CVI

The Crypto Volatility Index (CVI) is a VIX for crypto. The index was created by the COTI team, which partnered with Professor Dan Galai, the creator of the original VIX, to create a “market fear index” for the crypto market. CVI computes the implied volatility of BTC and ETH option prices while analysing the market’s expectation of future volatility.

At its core, the CVI owns and operates a basket of volatility products, including Armadillo’s impermanent loss protection, which is one of its most promising solutions for today’s liquidity providers.

About Armadillo

By using Armadillo, QuickSwap’s users will be able to supply liquidity to the platform. They won’t need to stake their LP tokens to purchase the Armadillo impermanent loss protection.

Armadillo is the only

- Multi-chain protection — Protects select pairs staked across any chain, DEX, or platform.

- Non-custodial — The liquidity does not have to be moved to purchase the protection.

- Customised — Each user sets the pair, amount, and timeframe to protect.

- Decentralised On-Chain protection — On-chain oracles and smart contracts are used to ensure security and manipulation resistance.

Users can simply purchase custom impermanent loss protection, specify the length of coverage, and be fully protected against a set amount of impermanent losses.

By doing so, users will be able to maximise the benefits that come from providing liquidity while hedging themselves against impermanent loss from potential volatility.

The smart contract calculates the premium based on variables such as the tokens’ price at the time of purchase, the premium duration, and the expected implied volatility using the CVI calculations.

Whiteboard video: https://www.youtube.com/watch?v=doIVILJ1-9w&t=1s

Whitepaper: https://armadillo.is/Armadillo-Whitepaper.pdf

Armadillo Launch Period — Data Analysis

The following data was derived from Armadillo’s launch phase, which ran from June 3rd, 2022 — August 31st, 2022.

- On 6/3/22 the beta was launched to the GOVI community with no PR or marketing outside of the community’s channels

- On 7/17/22 the product was launched to the public

Graph 1 — ETH/USDC price during launch (Range $991-$2021)

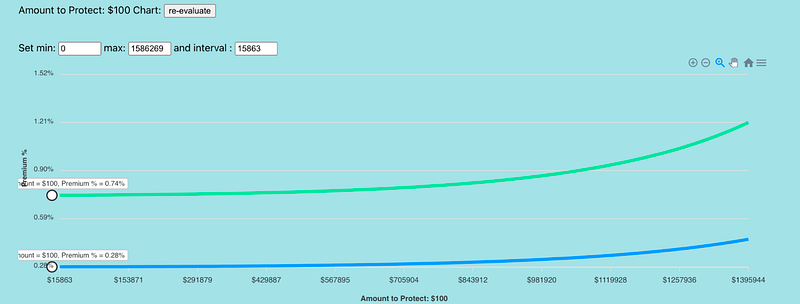

Graph 2 — Premium for ETH-USDC/Working Capital in the IL Vault

The above graph shows how the premiums increase as more collateral is used (given identical amount of liquidity).

At the time of analysis, the CVI was 91. The premium will be higher or lower depending on the CVI.

As you can see, over the 30 day period, the premium ranged from 0.74% to 1.22%.

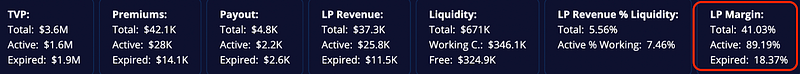

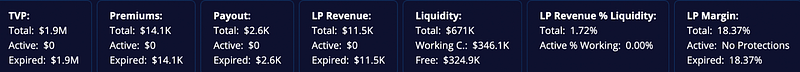

Armadillo Admin Panel, Showing Full Summary on 8/31/22

LP Margin (on the right) shows the average profit margin of LPs per protection, regardless of its size (weighted average).

From this data, we can see that average LPs suffered a loss from expired protections. This makes sense because ETH’s price dropped significantly when the beta period began and increased by more than 100% by the end of the period. Meanwhile, the total profit margin is 41.03%. That’s because over time, many of the protections expired with payout below the premium during the market’s stagnation periods.

Some protections will change significantly before the end of their protection period, so active protections might distort the data. Looking at expired protections will yield a better understanding of the product’s performance.

TVP — Total value protected

Premiums — Total amount of Premiums charged by Armadillo

Payout — Total amount of payback to the users

LP Revenue — Total revenue of Liquidity Providers from the “seller” side

Liquidity — Current total amount in the Liquidity pool from the “seller” side

LP Revenue % Liquidity — Total revenue of Liquidity Providers from the “seller” side/Current total amount in the Liquidity pool from the “seller” side

LP Margin — shows the average profit margin of LPs per protection, regardless of its size (weighted average). On average, Armadillo gives back 81.63% from the Premiums charged.

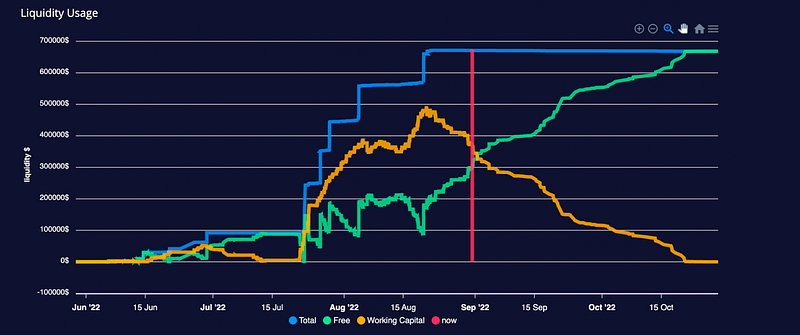

Graph 4 — Liquidity Usage (Future Projected)

- This graph shows the past and future projection of liquidity utilisation

- Working Capital is the most important factor

- Working Capital is the amount of liquidity used to cover the protection taken

- This metric is used to determine the size of the hedge required to protect liquidity providers from all possible market dynamics while accounting for their risk tolerance

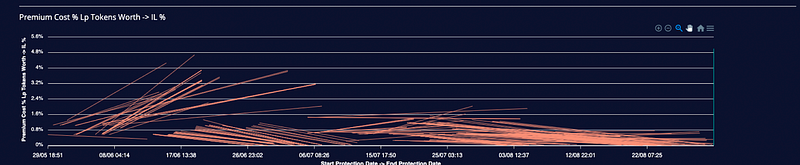

Graph 5 — Premium Costs vs. Payout (%) Historical Data

This graph compares the premium costs vs payouts as percentages of the liquidity buyers protected.

For each line (x1,y1,x2,y2) — y1 = premium paid, y2 = payout received.

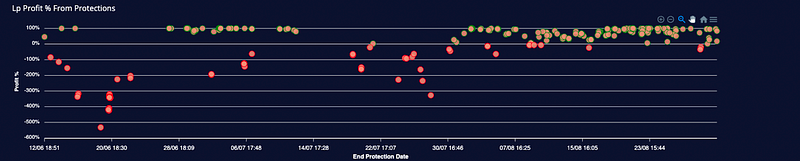

Graph 6 — LPs Profit & Loss % by Premium Received

This graph shows

- The vault’s payouts vs profits during stagnation periods.

- Initial payouts for protections taken during the early days of the beta launch, when the market significantly decreased

- Payouts about to be sent to buyers who took IL protections before the upwards market correction

- LPs’ big winnings during the stagnation period

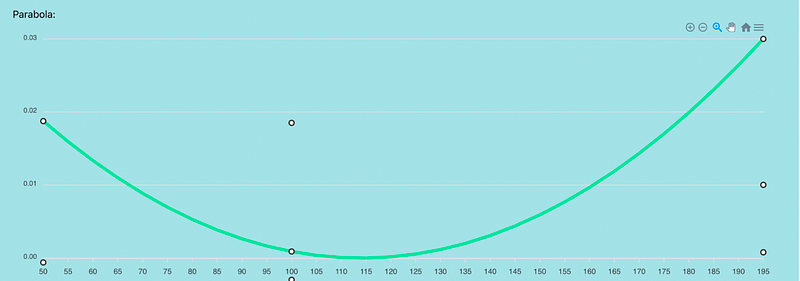

Graph 7 — Premium % by CVI Values

- The quadratic parabola fits the historical IL data with the CVI levels

- The data meets expectations. When the CVI is very high, there would be high IL due to significant downwards movement, when it’s very low it signifies stable growth, which also creates high IL.

QuickSwap’s many users rely on LPs to supply liquidity to trade their favorite assets. QuickSwap wants to do everything we can to minimise risk for our LPs. CVI’s Armadillo Insurance is one possible method for reducing the risk of Impermanent Loss (IL). To learn more, join the Twitter Spaces with CVI later today (9/21) at 1500 UTC (8 am PDT).

Please remember though, while QuickSwap is enthusiastic about the possibility this product offers to hedge against risk, we do not officially manage or endorse Armadillo IL Protection Insurance. As always, we encourage users to do their own research.

QuickSwap has so much to look forward to. Be sure to join us on social media to stay up-to-date with all things QuickSwap — Polygon’s most established DEX.