This guest blog was written with input from valued community members Tom & Aaron of APY.vision

Within the QuickSwap support channels, one of the most frequently asked questions is: “What is dQuick?” But while many want to understand the asset and how it works technically, others really just want to know how they can get some, so they can increase their QUICK supply. If that last part sounds like you, you can check out our step-by-step instructions for staking QUICK using the Dragon’s Lair here. Otherwise, keep reading.

How does staking work & where does the QUICK come from?

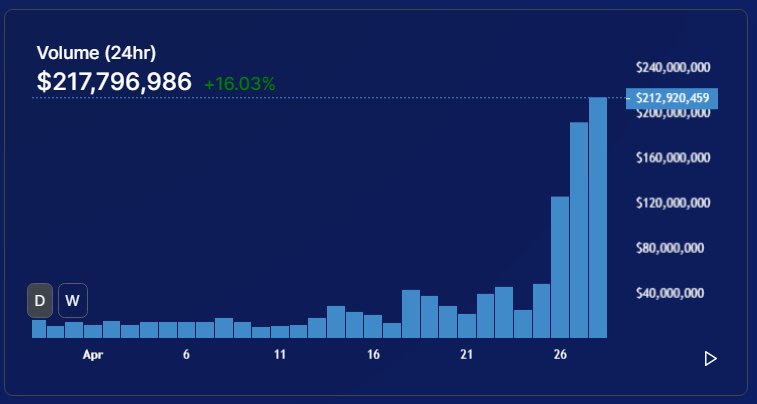

When users make trades on QuickSwap, the exchange charges a 0.3% fee (paid in tokens from the pools). The rewards for the Dragon’s Lair — or staking QUICK — come from those trading fees. 0.04% (out of the 0.30% fee) of the volume from trades on QuickSwap are used to market buy QUICK and distribute it to stakers. The acquired QUICK from fees is then divided up proportionally between the dQUICK holders in the pool, meaning their dQUICK increases in value relative to QUICK. The APY is variable. It depends on:

- Transaction volume

- QUICK’s market value

- and the total amount of QUICK staked

0.04% of the trading volume ($86,800) is being routed to dQUICK stakers

What is dQuick?

Put simply, dQuick is “Dragon’s Quick”. It’s the asset you receive when you deposit your Quick into the staking contract.

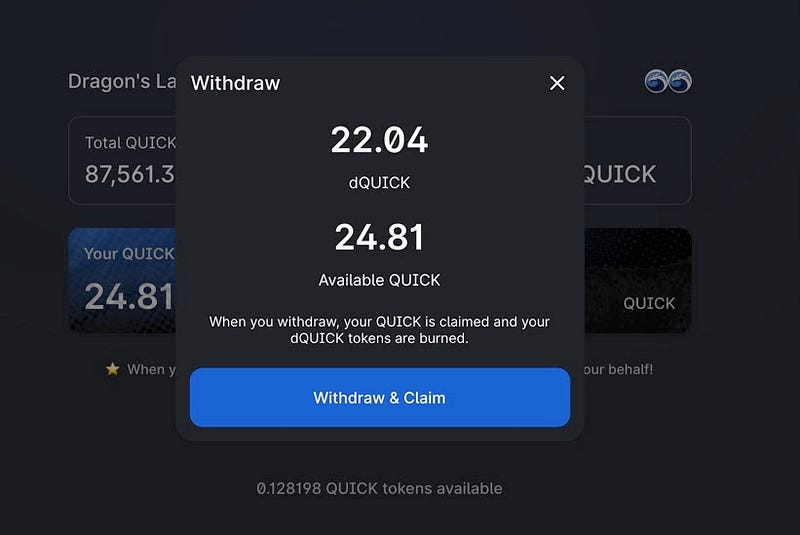

We understand that the variable rate of dQUICK:Quick can be confusing. The price of dQUICK changes over time depending on how much QUICK is deposited in the staking contract. As of this writing, the ratio of dQUICK:Quick is 1.12:1. This shows how the swap fees have increased the value and generated a yield for dQUICK stakers.

Put simply, users deposit QUICK, and they get a variable rate of dQUICK in return. The value of dQUICK increases over time as swap fees are generated. When you unstake (or “withdraw” from the staking contract), your dQuick is burned, and you get back more QUICK than you put in — based on the dQUICK rate.

The lower the dQUICK rate, the more QUICK you will receive when you unstake. One convenient feature is that there are no requirements for timed lockups of your funds, so you can withdraw anytime.

More information about dQUICK

The longer a person holds dQUICK, the more QUICK they will withdraw when the time comes.

The more technically inclined can check out the smart contract to get more specifics. The source code is pretty simple. Here it is.

How to Calculate APY

It’s important to note, that because APY fluctuates with several factors, if you’re a long-term staker, you can’t rely on it being the same as when you first deposited your QUICK (or even when you first did the math). From its inception until now, staking QUICK has yielded an APY of about 30–50%. For those who want to know how to calculate their APY here’s a formula:

APY = (Last 24h volume x 0.0004 x 365) / (# of staked QUICK x QUICK price)

You can also check it on Apy.vision here: https://matic.apy.vision/#/rewards/quickswap

How to Hoard like a Real Dragon

After reading this blog, we hope you have a better understanding of how the Dragon’s Lair and dQUICK works. Maybe even a good enough understanding to start staking for yourselves. Dragon’s hoard their treasure. Are you one?

Here’s that guide for How to Stake your QUICK one more time.

Roar!

By QuickSwap Official on April 29, 2021.

Exported from Medium on May 2, 2023.