The DragonFi 2.0 saga continues to heat up into 2024.

With the first pillar being revealed last month and suspense quickly building, the moment has come to dive straight into the second pillar: Revenue Streams.

Since its inception, QuickSwap has been a behemoth DEX that has withstood the test of time.

Not only did QuickSwap thrive throughout the last bull market but it also displayed great strength and resilience throughout the recent bear market, the longest in crypto history.

This can be primarily attributed to the various DeFi products and protocols that provide revenue inflows for the DEX, where a portion is also distributed to the community as rewards - better yet, they’re continuing to grow as the DragonFi ecosystem deploys new Citadels across Polygon CDK chains.

In fact, QuickSwap offers some of the best rewards across the entire Polygon CDK family while also remaining highly sustainable, a win-win that contributes to the ecosystem’s longevity.

Pillar 2: Revenue Streams - A Birds Eye View

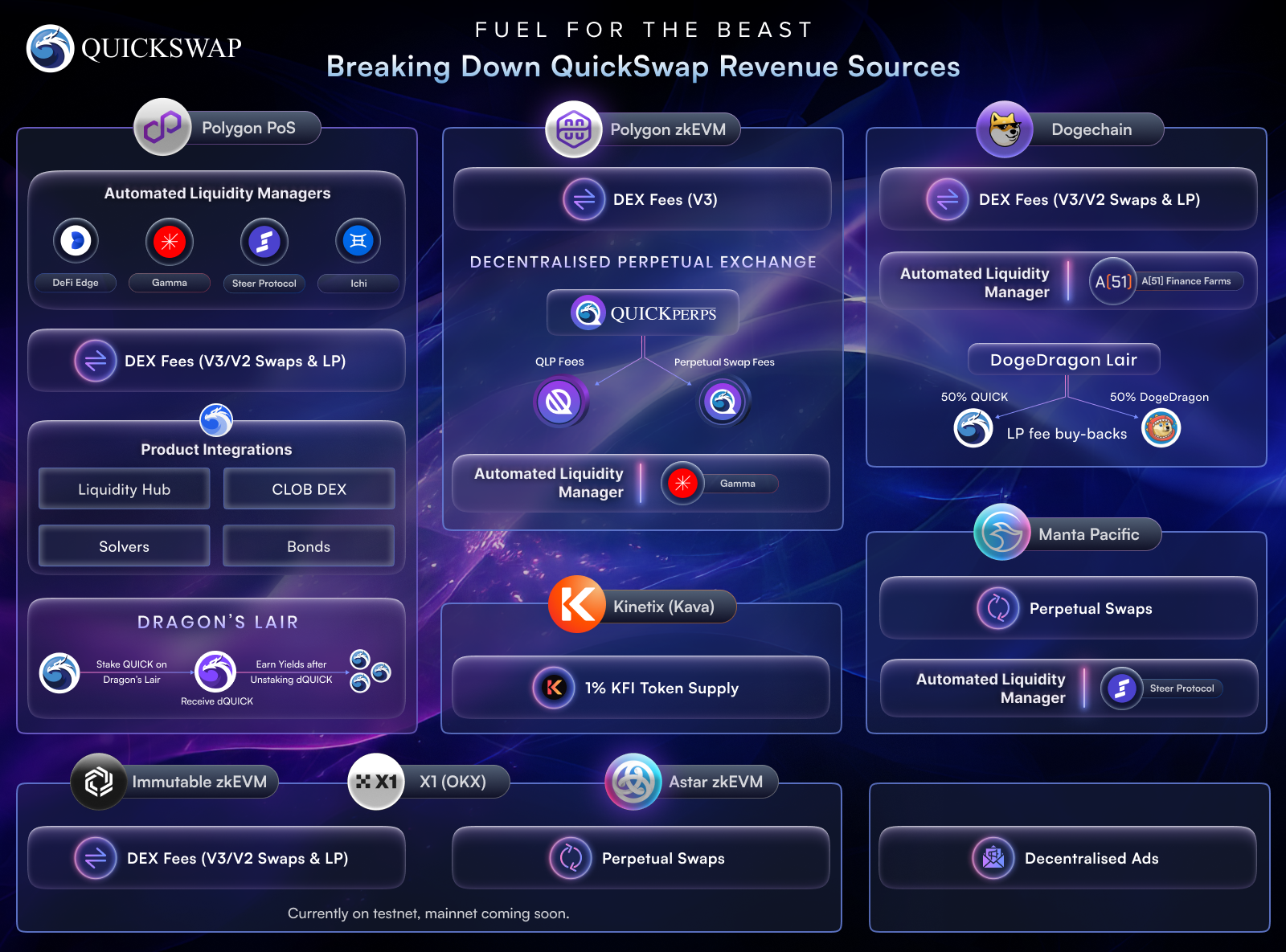

The below graphic provides a high-level glimpse so users can truly understand the vast array of revenue sources across QuickSwap’s DragonFi ecosystem.

Throughout this article, the individual revenue sources will be broken down across each chain in greater detail to give a comprehensive picture of how extensive each of them is and how they benefit both the DEX and overarching dragon community.

Keep in mind that these are current revenue sources - since QuickSwap continues to innovate and expand its DragonFi ecosystem, especially with future Citadels slated for deployment, there’s an unlimited realm of possibilities for more drivers to bring in protocol revenue.

Let’s jump in.

Polygon PoS

QuickSwap has led the charge in terms of on-chain stats and activity on Polygon PoS since the very beginning, reaching over $1 billion in TVL and $60+ billion in lifetime trading volume.

As a direct result of the DEX’s growth and success on Polygon’s main chain, it is also its largest revenue source.

Here’s a quick breakdown:

- DEX Fees: V3 and V2 swap and LP fees from on-chain activity

- Liquidity Hub: Directs/routes a user’s trade to the best price. If the trade goes through V2, it takes a 0.2% fee - if the trade goes through V3, there is a dynamic fee

- Solvers: Generates a dynamic fee between 0.1% and 1% depending on where the next base trade occurs (factors in the best possible execution price for the user, inclusive of the fee)

- CLOB DEX: Revenue will be based on trading fees when the product goes live, with more potential revenue streams being implemented in the future (TBD)

- Bonds: QuickSwap receives a small fee for setting up each project’s Bond on the frontend and backend

- ALMs: Revenue is generated from Gamma, Steer Protocol, DeFiEdge, and ICHI fees

Another key item is QUICK token staking - although this does not generate additional revenue for QuickSwap, a portion of the protocol’s revenue goes to the Dragon’s Lair which is then distributed to the community of QUICK stakers.

Polygon zkEVM

Also deploying on Polygon zkEVM in March 2023, QuickSwap’s various products and integrations have also driven revenue generation on this promising network.

- DEX Fees: V3 swap and LP fees generated from on-chain activity

- QuickPerps: QLP pool generates perpetual swap trading fees

- ALMs: Revenue is generated from Gamma fees

Other Polygon CDK Chains

QuickSwap has been consistently deploying on new Citadels to continue its Polygon CDK chain dominance. More governance proposals will be introduced in the future - meaning more potential chain expansion and a higher number of revenue streams.

So far, QuickSwap has launched on the following Polygon CDK chains:

- Manta Pacific: Revenue generated on DEX fees - V3 from trading fees for swaps, liquidity provider fees, and fees generated from Steer Protocol ALM (Automated Liquidity Management) farms - perps maybe coming soon

- Immutable zkEVM, X1 (OKX) Network, Astar ZKEVM: All 3 of these chains are in testnet phase and yet to launch on mainnet - when they go live on mainnet, potential revenue sources will include DEX fees (V3/V2), ALM fees, perpetual swap fees, and more

- Dogechain: Current revenue streams include V3 and V2 swap/liquidity provider fees, A[51] ALM farms, and DogeDragon (DD) token LP fee buyback in 50% QUICK and 50% DD. Their recent governance vote to move to zkEVM recently passed, meaning the shibes are coming to the Polygon CDK family

Other Revenue Sources

Outside of the main Citadels that make up QuickSwap’s Polygon-based DeFi hub, below are additional revenue streams within the DragonFi ecosystem:

- Kava (Kinetix) Token Supply Airdrop: 1% of the KFI token supply will be distributed to the QuickSwap community after TGE

- Decentralised Advertisements: QuickSwap displays advertisements across certain parts of the website which generate revenue from clicks

QuickSwap: A Force to be Reckoned With

With such a diverse range of revenue streams that continue to expand, QuickSwap’s ability to continue to sustain itself and distribute rewards to the community is a testament to its success.

And it doesn’t stop there. As QuickSwap launches new Citadels and keeps innovating, the door widens to add even more revenue sources and opportunities that will benefit both the DEX and community.

That’s a wrap for Pillar 2 of DragonFi 2.0. Stay tuned for the third pillar - the fire is coming.