TL;DR

- Dual farming yields rewards in two crypto assets and often increases profits

- QuickSwap has launched dual farming rewards for select Matic pairs

- Liquidity providers to select pools will receive rewards in both $MATIC and $QUICK

- Learn how to receive LP rewards in both QUICK and MATIC today

Everyone knows that dragons love treasure! That’s probably why we’ve seen so much success with projects that have offered dual farming rewards with QUICK. At QuickSwap, we want to give you more of what you love, so we decided to launch our own dual farming program, starting with $1 million in MATIC with more coming soon!

Last month, we announced that Polygon issued a $1 million grant to QuickSwap (in $MATIC) to bootstrap our DEX with additional liquidity and promote dual farming rewards for select pairs. They include

- MATIC-ETH

- MATIC-USDC

- MATIC-USDT

- MATIC-QUICK

What Is Dual Farming?

Dual farming is a staking reward method in which liquidity providers (LPs) receive rewards for their liquidity in the form of two cryptocurrencies instead of just one. In this case, LPs will earn rewards in the following ways

- LPs receive a portion of the trading fees the DEX collects from the pair in question. These rewards are paid out at several daily intervals and autocompunded into the LP’s position. They are paid in the 2 assets that are in the pool

- After depositing liquidity, LPs deposit their LP tokens to earn $QUICK & $MATIC

What are the benefits of Dual Farming?

Like we said, we want to provide our dragons with the best tools available to increase their treasure hoards. Dual farming is one such tool. Dual rewards can augment liquidity provider yields by boosting pool APYs. Rewards received in two digital currencies can offer LPs increased asset diversification and potentially reduce volatility.

Potential Risks Impermanent Loss in a Nutshell

The main drawback when it comes to participating in any kind of liquidity provision, dual farming included — is the potential to experience impermanent loss. Impermanent Loss (IL) refers to the potential loss one takes when providing liquidity for a pair. It occurs whenever there is a sharp divergence in the price of tokens. These losses are referred to as “impermanent” because if one continues providing liquidity for the pair, the losses may be reversed if the tokens they provided return to their original ratio.

For example, let’s say Tyler provided liquidity for the MATIC-QUICK pool and QUICK increased rapidly against MATIC. Tyler would lose some QUICK and gain some MATIC to rebalance the liquidity he provided. If he removed his liquidity from the pool, then these losses are realized, but if he remained in and the ratio were to rebalance (in this case meaning MATIC gained on QUICK at the same pace QUICK gained on MATIC), then Tyler wouldn’t realize any losses, ie, the losses Tyler suffered were impermanent.

All liquidity pairs are subject to the possibility of impermanent loss, but liquidity mining rewards (particularly dual farming rewards) reduce the risk of loss by offering high APYs.

Dual-Farming Compared to QUICK Staking & Dragons Syrup

QuickSwap users now have a total of three farming options

- QUICK Staking Users can single-asset stake $QUICK, QuickSwap’s native token, via the dragon lair and receive a portion of the fees generated on the platform (paid in QUICK). With single-asset staking, there is no risk of impermanent loss, and users also receive a staked-representative asset called dQUICK.

- Dragon’s Syrup Recently introduced, QuickSwap’s new Dragons Syrup program allows QUICK’s single-asset stakers to use their $dQUICK to farm their choice of additional assets with no risk of impermanent loss.

- Dual Farming Users can participate in 50/50 dual farming liquidity pools that payout rewards in MATIC and QUICK. There is a risk of experiencing impermanent loss.

How to Dual Farm On QuickSwap

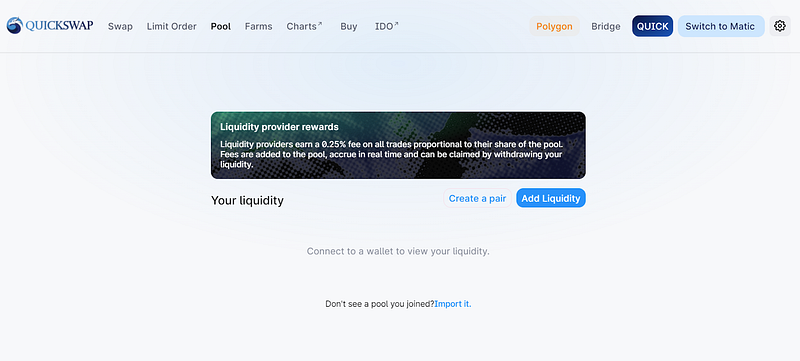

Head over to quickswap.exchange and add liquidity via the “Pool” tab. Deposit the specified coins required to participate in your desired dual-farming pair and receive LP tokens.

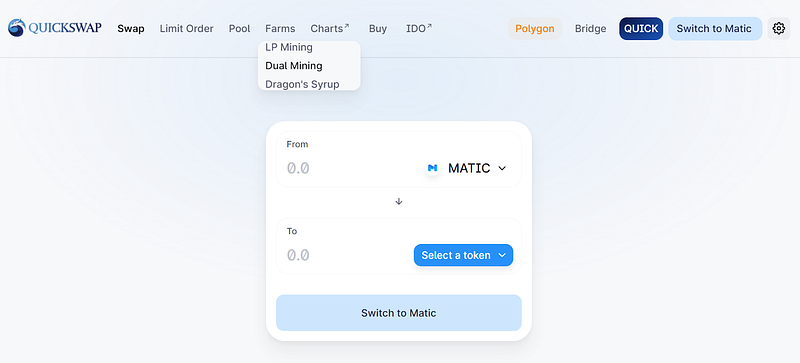

Then go to the “Farms” tab and select “Dual Mining” from the drop-down menu. Select the eligible pool and deposit the recently received LP tokens.

Early Adopters Benefit Most

As with almost everything, the early dragon gets the treasure. In time, we believe that QuickSwap’s dual-farming feature will prove to be the most lucrative option for early adopters. As word gets around and these pools gain more notoriety, more liquidity ultimately results in lower yields.

Why wait? Two is always better than one.

Happy farming!

Come join QuickSwap’s awesome community of DeFi enthusiasts across our social media platforms today to learn more about dual farming and so much more!

DEX | Twitter | Telegram | Announcements | Medium | Discord | Reddit

By QuickSwap Official on November 4, 2021.

Exported from Medium on May 2, 2023.