Update: On October 24th, QuickSwap closed our lending markets after $220k was exploited in a flash loans attack due to a vulnerability in the Curve oracle, which Market xyz was using to monitor the lending/borrowing markets. Please note, only the Market xyz lending market was compromised. QuickSwap’s contracts were unaffected, and no user funds were lost.

QuickSwap is proud to present QuickSwap Lend. A brand new decentralised lending and borrowing suite, accessible directly from the QuickSwap homepage. QuickSwap Lend allows users to access debt financing, maximise yield as liquidity providers, and conduct flexible risk management in alignment with their personal financial strategies, all while contributing to a more stable and robust QuickSwap DeFi ecosystem.

Getting Started

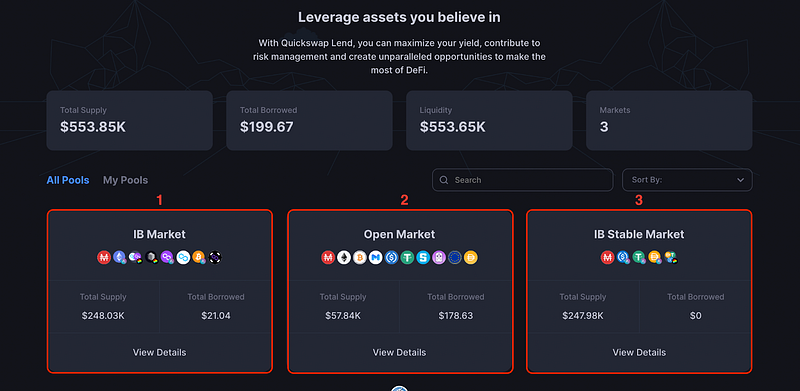

To start using QuickSwap Lend, head straight to the QuickSwap homepage and select the “Lend” tab. Atop the screen, you’ll see the aggregate data for all QuickSwap Lend markets and each individual market.

Now, let’s dive in and get our hands dirty.

Choose Your Market

QuickSwap Lend supports 3 markets:

- Open Market: A standard lending market that supports the most comprehensive array of assets.

- Users may borrow select assets in exchange for supplying supported assets.

2. IB Market: A market for interest-bearing capital.

- Users may borrow MAI in exchange for interest-bearing assets.

3. IB Stable Market: A market for supplying interest-bearing stablecoins.

- Users may borrow MAI in exchange for interest-bearing stablecoins.

Gauge Your Market

As always, at QuickSwap, we are committed to providing our users with a simple, intuitive UI to make it easy to access and explore critical metrics and real-time market data. Making sense of relevant metrics, the Supply and Borrow interface, Pool Info, and Asset Utilisation Statistics for each market will help you make informed decisions about your capital.

Important Terms

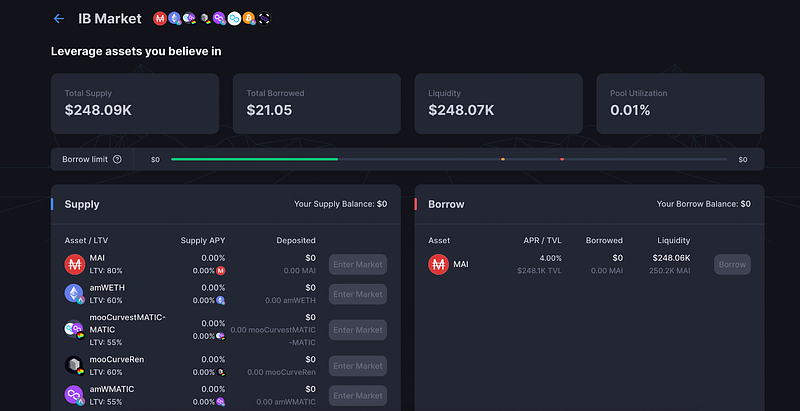

Once you select a market, important aggregate metrics will be displayed atop the screen. All figures are quoted in USD.

Total Supply: Total value of assets supplied to the market.

Total Borrowed: Total value of assets borrowed from the market.

Liquidity: Total liquidity available in the market.

Pool Utilisation: The total value borrowed as a percentage of the total value supplied.

Below, the UI displays your personal Borrowing Limit and the assets you have supplied and borrowed from the market. For example, in the case of the IB Market shown above, all supported interest-bearing assets are displayed on the supply side (left). MAI is displayed on the borrowing side (right). As you supply assets to and borrow assets from a market, these figures will update accordingly.

Your Borrowing Limit measures the maximum value the protocol will allow you to borrow from a specific market. As is generally the case in capital markets, supplying more capital will increase your Borrowing Limit.

Determine Risk and Return

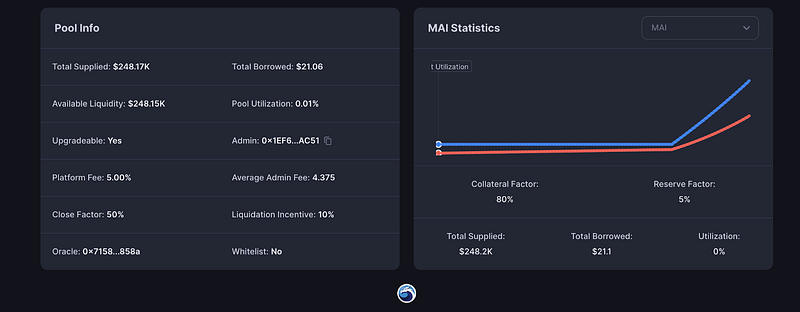

Scrolling down, you will see a pair of boxes displaying important data for assessing risk and return. Evaluating these metrics is essential in understanding what you stand to gain and lose by supplying and borrowing from a particular market (left) and with specific assets (right).

Here’s the critical principle: Like all DeFi protocols, QuickSwap Lend leverages incentives to maintain healthy and robust markets. Primarily, that means adjusting interest rates to balance the age-old market forces of supply and demand. And don’t worry — it’s not complicated. If you understand 2 key relationships, you’ll be a QuickSwap Lend pro in no time.

I. Maximising Return: Utilisation Rates & Interest Rates

- When a market is heavy in assets supplied and light in assets borrowed, its Utilisation Rate is low. Therefore, the QuickSwap Lend protocol decreases interest rates to incentivise borrowing to balance the demand.

- When market demand for borrowing increases relative to assets supplied, its Utilisation Rates increases. Thus, to balance the market, the QuickSwap Lend protocol increases interest rates to incentivise lenders to balance the supply.

II. Minimising Risk: Liquidation Incentives, Collateral Factors, & Reserve Factors

When you supply one holding and borrow another, the values of your provided and borrowed assets may fluctuate over time. If the value of your endowed assets falls below a certain threshold, the protocol will sell your effects to maintain the market’s health. This process is called liquidation. The Liquidation Incentive metric is the payment (as a percentage of your position) that a liquidator receives.

To correctly manage risk and reduce your chances of getting liquidated, the Collateral Factor metric displays the percentage of your supplied capital that you may borrow on a per-asset basis. For instance, a 75% Collateral Factor indicates that you may borrow a maximum of $75 for every $100 you supply. However, borrowing the maximum places you at very high risk; should your supplied assets lose value relative to your borrowed assets, you may be liquidated promptly. At a Collateral Factor of 75%, borrowing $50 for every $100 you supply to the protocol significantly reduces your risk of liquidation.

The Reserve Factor is the final piece of the risk management puzzle. The Reserve Factor measures the buffer between a secure position and one that will enter liquidation. Thus, a Reserve Factor of 5% indicates that if your capital situation — relative to its Collateral Factor, of course — comes within 5% of its designated liquidation threshold, it will be liquidated. As a result, the Reserve Factor plays a vital role in protecting the integrity of DeFi lending protocols. Therefore, all users should consider it before borrowing assets from any market.

Final Considerations

Lastly, there are a few extraneous metrics that the QuickSwap team is reevaluating in light of user feedback.

- Under “Pool Info,” Platform Fee and Average Admin Fee indicate nominal fees that are paid to the protocol. These metrics will be removed in subsequent versions and do not reflect interest rates in any market or supported assets therein.

- “Upgradeable” refers to the QuickSwap team’s capacity to modify a particular market via multisign functions. Such changes include adding support for additional assets and modifying interest rates.

Do you still have questions about QuickSwap Lend? No problem — join the conversation! Follow QuickSwap on social media, and contact our team directly via our official community channels below. We look forward to hearing from you!