Update: This guide explains how Impermanent Loss (IL) works with examples using our V2 DEX. Our V3 ‘concentrated liquidity’ model is different, and IL is different on V3 as well. Here is a link to a guide that explains how IL works on V3.

One of the most frequently asked questions we hear at QuickSwap is “what are impermanent losses” and “how can I prevent them”? We understand that you want to protect (even increase) your hoard, and you may have heard that providing liquidity on a DEX is one way to do that. It’s true that many have had great success liquidity farming on AMMs. Yet others have suffered from massive impermanent losses that they’ve made permanent. So first, what does that term even mean?

What are “Impermanent Losses”?

Impermanent Loss (IL) refers to the potential loss one takes when providing liquidity for a pair. It occurs whenever there is a sharp divergence in the price of tokens. These losses are referred to as “impermanent” because if one continues providing liquidity for the pair, they may be reversed if the tokens they provided for return to their original ratio.

For example, let’s say Bryant provides liquidity for the QUICK-ETH pool and QUICK increases rapidly against ETH. Bryant will lose some QUICK and gain some ETH to rebalance the liquidity he provided. If he removes his liquidity from the pool, then these losses would be realised, but if he remained in, and the ratio rebalances (in this case meaning ETH gains on QUICK at the same pace QUICK gained on ETH) then Bryant would have no losses, ie, the losses Bryant suffered were impermanent.

Why does IL happen?

QuickSwap — like UniSwap — is an AMM, which stands for Automated Market Maker. On AMMs, coins’ and tokens’ prices don’t adjust with the external market. AMMs rely on the market automatically adjusting itself through the process of arbitrage.

Arbitrageurs take advantage of price disparity between markets to capitalise. They buy and sell under or overpriced assets until the price on the AMM reflects that of the external market.

Impairment losses are most common on highly volatile pairs. So it’s necessary to determine your risk tolerance before you begin providing liquidity. Will you check every few hours to see how your pair is doing? Do you believe both assets in the pair you provide for will fare well long term? These are questions that only you can answer.

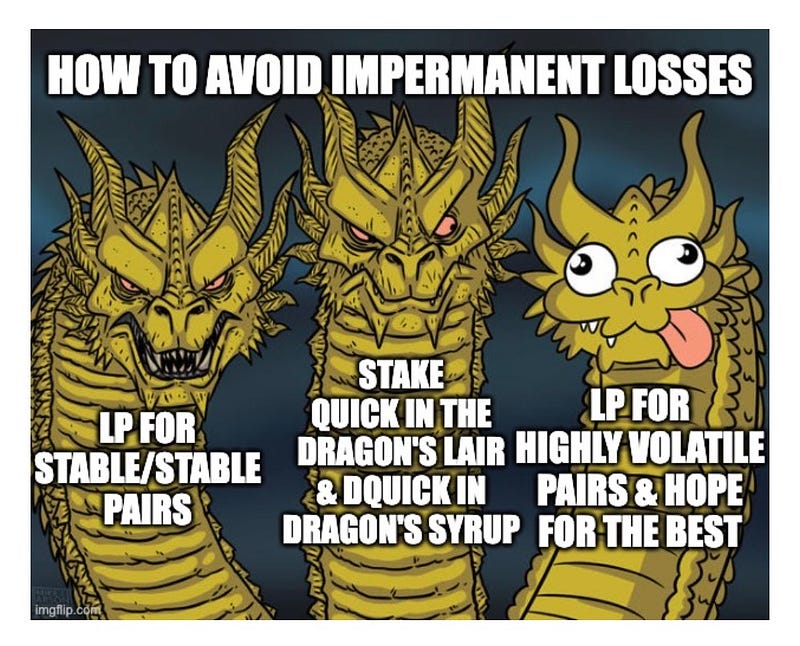

How to prevent IL?

The clear and obvious way to protect yourself from experiencing impermanent losses is to not provide liquidity. That said, many cannot withstand the potential of earning over 100% APY in addition to the gains from yield farming pairs in our QuickSwap rewards program. So if you’re set on participating, the best way to minimise losses is to select a pair (or pairs) that are relatively stable.

Method One: Providing for Stable/Stable Pairs

Some people chose to do this with stable coin pools, like USDT-USDC, DAI-USDC, DAI-USDT, MAI-DAI, and MAU-USDT. Since these assets are all pegged to the dollar (and stay relatively close to $1), the risk of impermanent loss in providing for them is substantially lower than with other pairs.

At the time of writing, the APRs for those pairs are as follows:

- USDC/USDT — 18%

- DAI/USDC — 12%

- DAI/USDT — 18%

- MAI-DAI — 20%

- MAI — USDT — 28%

From this dragon’s perspective 12–28% APY for a stable-to-stable pool with minimal risk of impermanent loss sounds like a good deal. But keep in mind, APY isn’t set in stone, and it depends upon you continuing to compound the interest you’ve earned within the pool rather than taking profits.

For instance, let’s say Nicole decided to provide $2k for MAI/USDT pool (which pays 28% APY). Let’s also assume she has no intention of taking profits during the year and will allow the funds to auto-compound, including the dQUICK rewards. After one year, Nicole would likely recoup all of her initial investment ($2k plus 28%, which would be $560. This added $560 would be split between the assets in her pool and dQUICK, which could also be used to generate additional income via the Dragon’s Syrup program, but we’ll get more into that later. As you can see from this example, one method for earning compound interest while minimising your risk for impermanent loss is to LP for a stable/stable pair.

But that’s not enough for some. Those with less aversion to risk, may be more inclined to take on a bit more of it.

Method Two: Providing for two assets you believe in long term

Many who want to see bigger potential rewards than stable/stable pools can offer, opt to instead provide liquidity for pools that contain two assets they believe will both be valuable over time. One pool that many in this camp opt into is the MATIC-USDT pool, which is currently offering 56% APY. Pools like the MATIC-USDT pool can also be beneficial because of the dual rewards currently offered to LPs for select MATIC pools. Read more about that here.

Method Three: Don’t LP! Stake & Stake Again

For those who want to not only minimise but actually eliminate the risk of impermanent loss altogether, QuickSwap has some amazing options that allow users to generate yield without risking their assets. QuickSwap’s “Dragon’s Lair” offers single-asset staking for the DEX’s native governance and utility token QUICK. Just stake your QUICK in the Dragon’s Lair and you’ll receive a portion of the trading fees collected by the DEX, paid out in regular intervals. Currently, the APY in the Dragon’s Lair is 21.81% and there is no lockup period, meaning you can deposit and withdraw at any time without incurring penalty fees.

Another option, for those who would prefer to earn a token other than our DEX’s native $QUICK, is to stake your QUICK to farm a variety of tokens offered via the DEX’s “Dragon’s Syrup” program to earn additional yield, all with no risk of impermanent loss. As of the conclusion of our governance vote on January 14th, 2022, QuickSwap is separating the Dragon’s Lair from Syrup Pools. Stakers will now have the option to chose between earning more QUICK and earning another participating rewards token.

Wrapping Things Up

Essentially, there is no way to provide liquidity and remove all risk of IL, but QuickSwap offers several options for earning yield without risking any losses. It’s up to you. Will you chase high APYs at your own peril? The choice is yours to make!

Come join QuickSwap’s awesome community of DeFi enthusiasts across our social media platforms today to learn more about impermanent losses and how to avoid them today.

DEX | Twitter | Telegram | Announcements | Medium | Discord | Reddit

By QuickSwap Official on November 17, 2021.

Exported from Medium on May 2, 2023.