Say goodbye to the old days of separately providing liquidity and farming. QuickSwap is all about innovation, and the DEX’s UI/UX has just gotten a massive upgrade for LPs.

QuickSwap has implemented its new Merkl tree integration, taking V3 LPing and farming to a whole new level on Polygon.

Easier process. Greater efficiency. Seamless experience.

Available for all supported ALM (Automated Liquidity Management) V3 farms on Polygon PoS.

Learn more about what it means for the DEX and community below.

1-Click LP & Farm

Merkl is a platform that lets LPs on concentrated liquidity pools receive flexible token rewards from projects that incentivise liquidity. Check them out at https://merkl.xyz/.

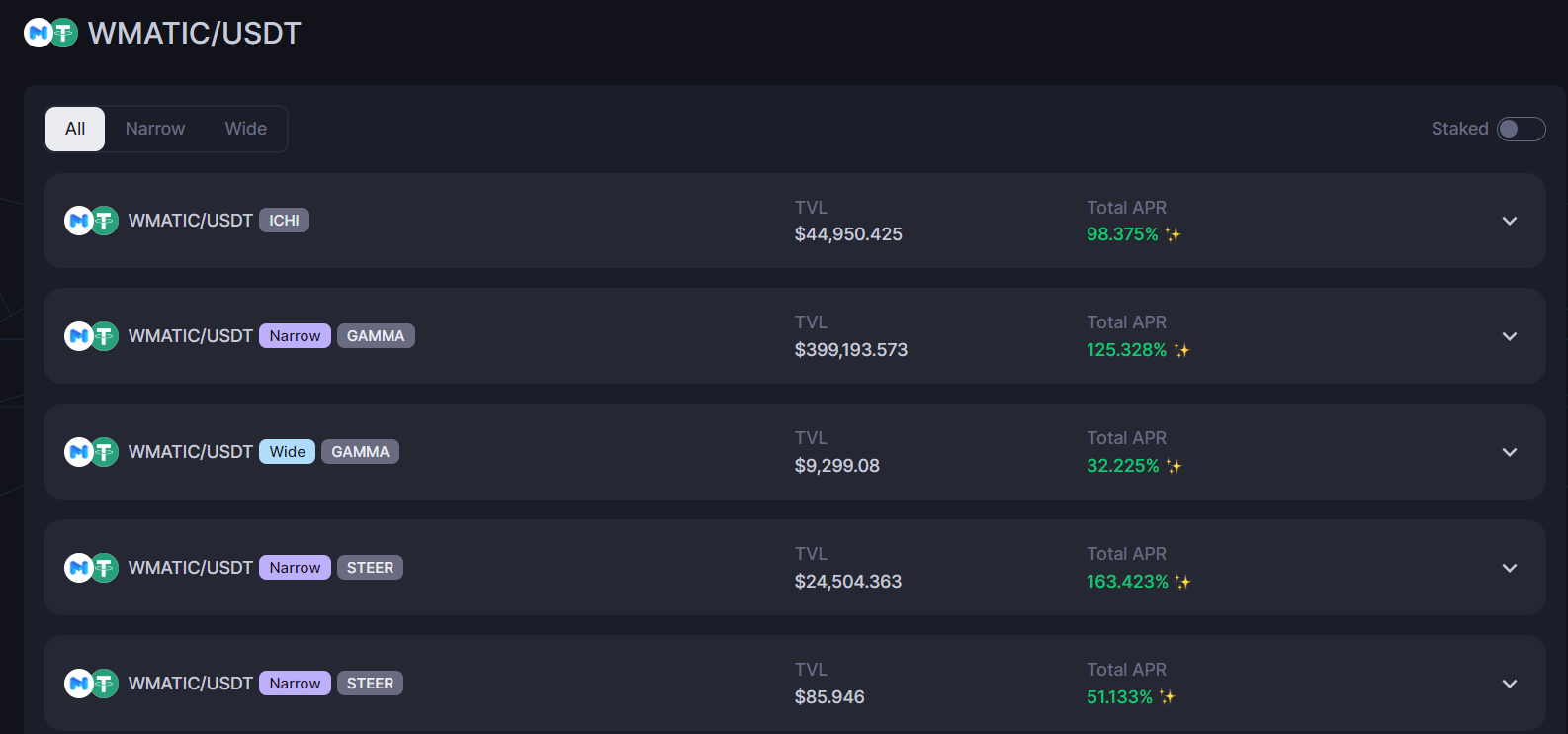

So far, QuickSwap has integrated Gamma, Steer Protocol, Ichi, and DeFiEdge V3 ALM farms, which are a more capital-efficient way to provide liquidity and farm, keeping a user’s liquidity in range, auto-compounding rewards, and much more.

With QuickSwap’s Merkl tree integration, users can LP and farm in 1 click instead of going through the previous 2–step process: providing liquidity to a token pair and then separately staking those LP tokens in a few to earn the additional farming rewards.

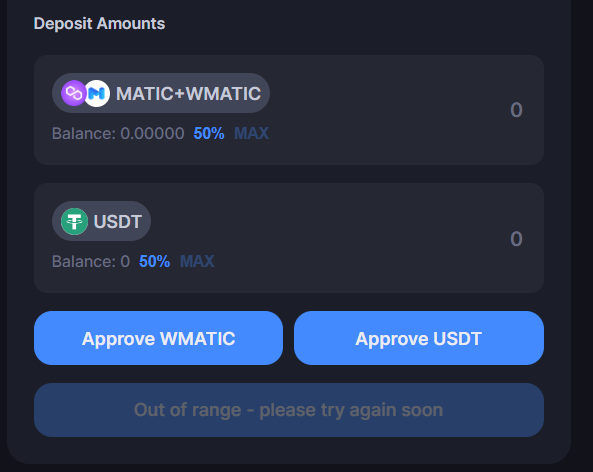

Now, once a user provides liquidity to a token pair on V3 that is supported by one of the 4 ALM farms (mentioned above), their liquidity position starts earning LP rewards in addition to the extra farming rewards.

LP and farming made easy!

Mechanics

So how exactly does the Merkl tree integration work, and why is it so much more efficient?

Merkl’s system and technology has the ability to automatically read every user’s on-chain LP position. By doing so, it can evaluate which users have qualified to receive a piece of the farming rewards pie before distribution.

All emissions (LP and farm rewards) are pooled together through Merkl’s new farming method, also allowing the ALM providers to access additional token rewards and more seamlessly create custom strategies for supported tokens.

Not only does the Merkl tree integration for ALM farms benefit the community with an easier process but also improves the efficiency for rewards management and distribution for the DEX and ALM farms.

A win-win!

ALMs (Automated Liquidity Managers)

Below is a list of the currently supported ALMs where you can LP and farm using the new Merkl tree integration:

Gamma

A protocol for active liquidity management and market making strategies. They manage liquidity of leading DeFi and Web3 protocols using tailor-made strategies, which aim to maximise capital efficiency, reduce the cost of emissions, or maintain consistent in-range liquidity with low price impact.

DeFiEdge

DefiEdge is the most innovative solution to deploy liquidity and optimise yields on concentrated DEXs. They create a non-custodial, permissionless layer over concentrated liquidity AMMs, enabling seamless liquidity deployment with efficient management tools.

In-built limit orders and support for multiple ranges (up to 20) expand the management capabilities of strategy managers so that they may use their entire repertoire of market understanding to manage liquidity.

They also provide an easy interface for liquidity providers and strategy managers to monitor their token positions in real time from their intuitive UI. Built-in liquidity mining rewards and automatic integration with Merkl protocols make incentivising liquidity on selected pools quick and easy.

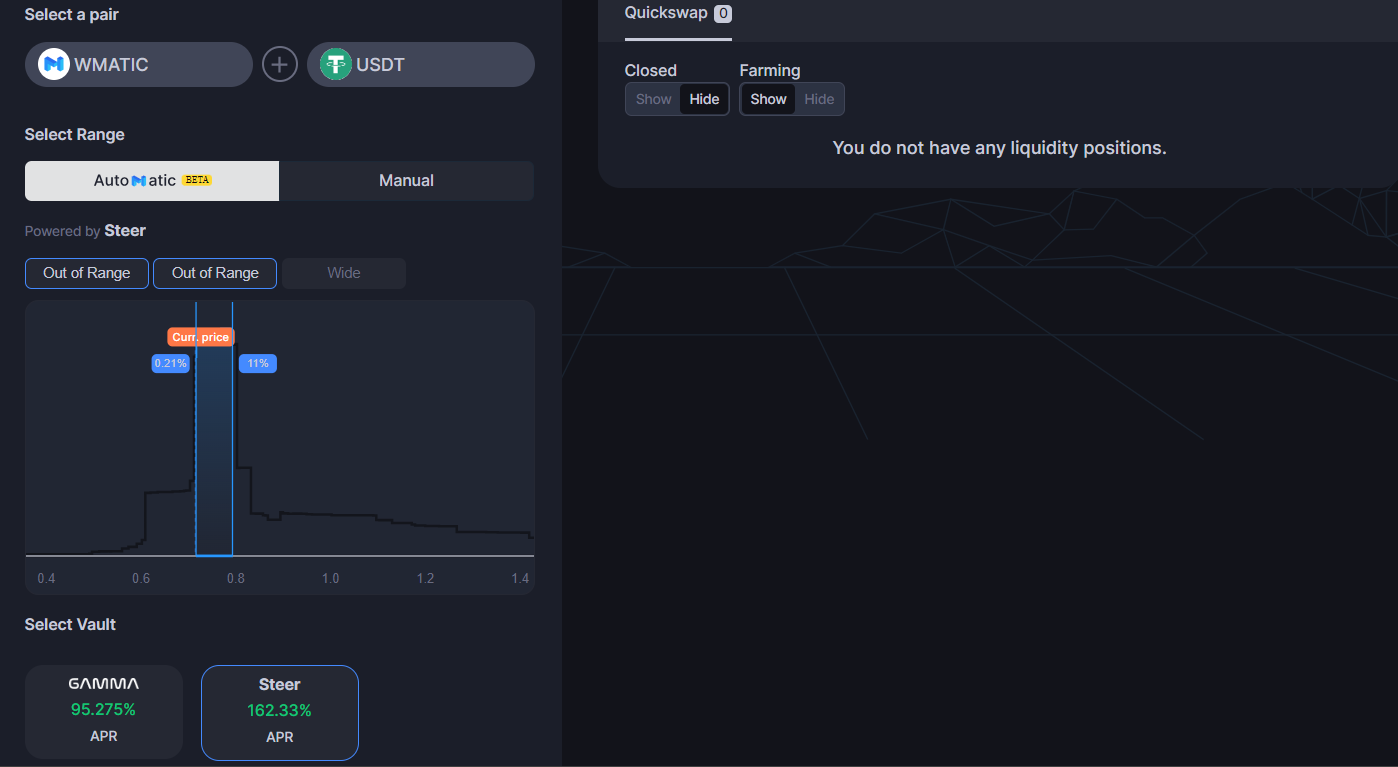

Steer Protocol

Steer Protocol distinguishes itself through its innovative off-chain compute protocol, seamlessly integrating off-chain and on-chain data to propel its advanced liquidity automation. It excels in managing over 780 liquidity strategies and supports more than 250+ assets, offering LPs superior fees with some of the highest APRs in the industry.

A distinctive feature of Steer Protocol is the ability for users to quickly create Smart Pools permissionlessly. This capability is coupled with access to the largest library of data-driven algorithmic LP strategies and a customizable SDK for strategy development. Additionally, Steer Protocol is the only platform offering strategists a share of generated fees from pools using their strategies.

With its ability to support a vast range of assets across 17 chains and over 90% of concentrated liquidity AMMs, Steer Protocol is a leader in providing adaptable, efficient, and secure liquidity solutions. For further details, visit https://steer.finance.

ICHI

ICHI's Yield IQ vault technology introduces efficient and profitable liquidity provision on QuickSwap, operating on the principle of dynamic liquidity management.

ICHI's algorithm ensures optimal token concentration, mitigating risks and offering LPs protection from significant losses during market fluctuations. This is all single-sided, so users only need to deposit one side of the pair to earn more of their favorite token.

How Can I Get Started?

Getting started is easy - make sure to follow the steps below to LP, farm, and earn rewards on QuickSwap!

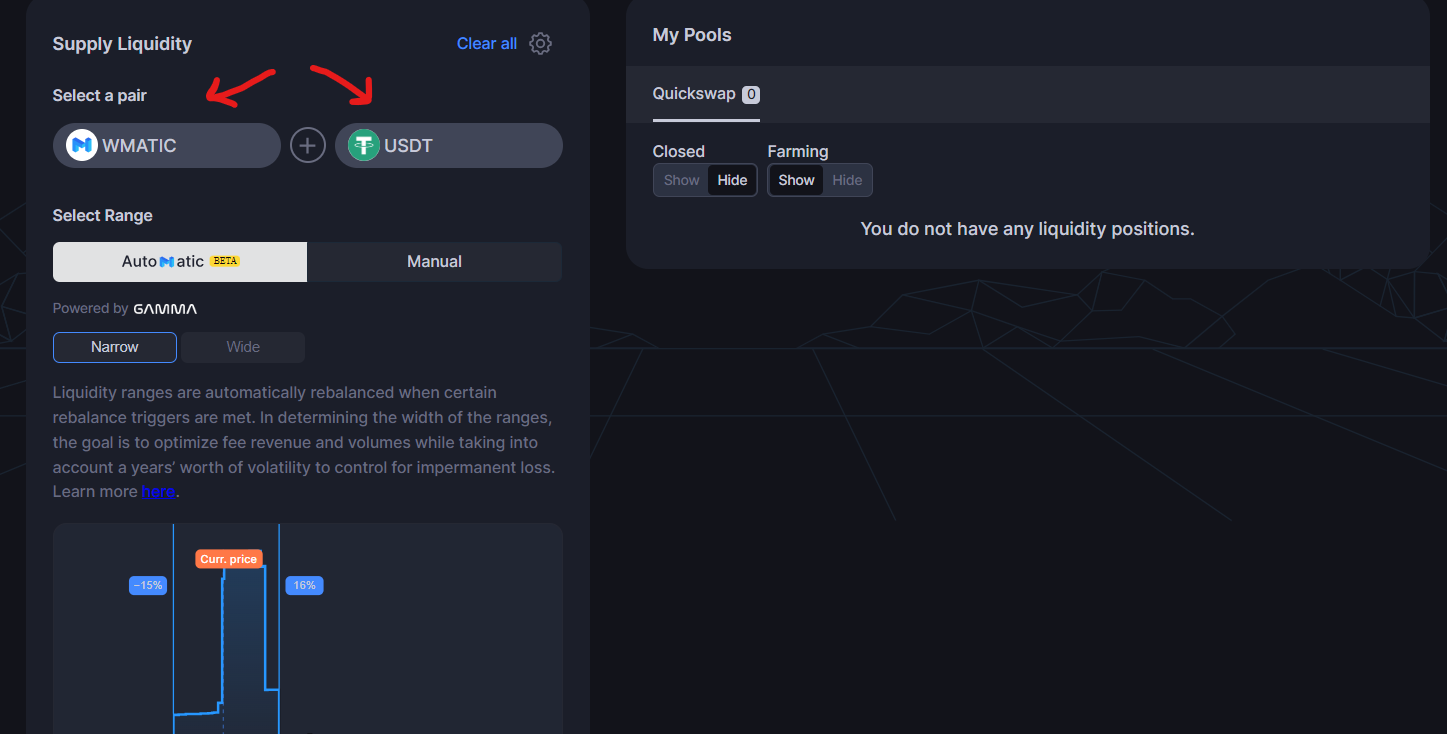

1. Go to https://quickswap.exchange/#/pools and connect your Web3 wallet - make sure the network is switched to Polygon PoS (Proof of Stake)

2. Supply liquidity by selecting two tokens from the dropdown menu and choose your desired range. To see which LP token pairs are eligible for farms, you can check https://quickswap.exchange/#/farm.

To be eligible to earn farming rewards from a supported ALM farm (in addition to LP rewards), the different ALM strategies will appear with the range options (narrow/wide) and total APR displayed. Choose the one you want and finish depositing the token pair.

3. You’re all set! You’ll immediately begin earning LP and farming rewards on your liquidity position. Go to the “My Pools” section on the top right of the Pools tab to check your portfolio.

You can also go back to the "Farms" tab and view all of the different ALM strategies and rewards for each eligible token pair.

Happy LPing and farming, dragons!

Unstake from Old/Legacy Farms

If you're still staking your LP tokens/farming in the old pools and want to use your liquidity to LP with the new Merkl integration, you'll want to unstake your liquidity to do so.

Head over to https://quickswap.exchange/#/pools/, find your token pair, and unstake.

If you're still providing liquiity to legacy pools (around 2021 or before), go to https://legacy.quickswap.exchange/#/archive, connect your wallet to the Polygon network, and simply unstake your LP from the pool under the "Old Pools" section.

Once you're all set, follow the tutorial above to LP with the new Merkl tree integration!