A brand new year has just begun! In January, you voted and we changed to a new rewards structure, we added several new liquidity mining pools, and we gave away millions in Dragon’s Syrup and liquidity mining rewards.

Data Recap

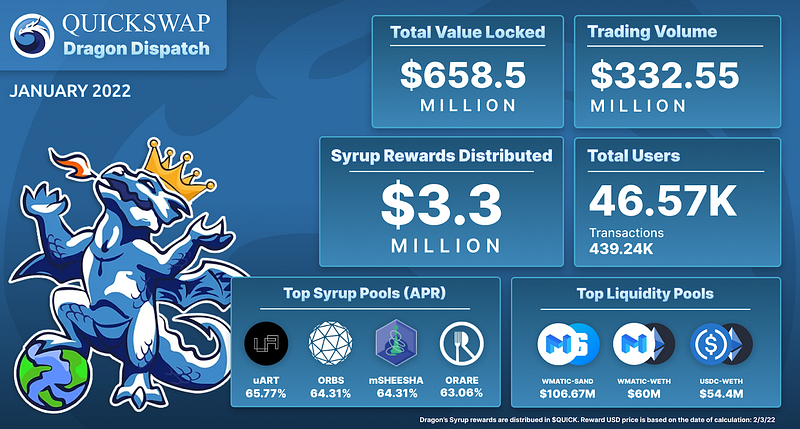

Overall

- TVL: $658.5M

- Syrup Rewards Distributed: $3.3 million

- Trading Volume: $332.55 million

- Total Transactions: 439.24 thousand

New Liquidity Pools + APY (As Of February 7th, 2022)

- ORBS-USDC — 39.12%

- UST-MATIC — 64.26%

- uART-USDT — 659.72%

- mSHEESHA-USDT — 1081.64%

- BCMC-MATIC — 244.11%

- SAFLE-USDC — 1660.14%

- NACHO-ETH — 566.48%

- RELAY-QUICK — 194.86%

- BOOK-MATIC — 1975.33%

- DOGIRA-MATIC — 950.81%

- ORARE-USDT — 822.93%

- ATLX-USDC — 1354.98%

- AWX-USDC — 914.86%

- KEYFI-QUICK — 1072.76%

New Syrup Pools + APR (As Of February 7th, 2022)

- CLAM — The OtterClam rewards pool ran from January 4th — February 3rd. $50,000 in $CLAM was distributed to dQUICK stakers.

- BLANK — 25.72% APR (plus 22.9% APY in the Dragon’s Lair for QUICK staking).

- PSP — 19.21% (plus 22.9% APY in the Dragon’s Lair for QUICK staking).

- RELAY — 32.97% APR

- BCMC — 61.8% APR

- ORBS — 61.78% APR

- mSHEESHA — 55.84% APR

- uART — 58.01% APR

- DOGIRA — 58.6% APR

- AWX — 57.95% APR

- ATLX — 60.35% APR

- ORARE — 57.43% APR

New Year, New Dragon

We’re starting out the new year on the right foot with a brand new, ever-evolving monthly newsletter! We’ve got a lot of big things happening this year. We’re working hard in the lair to bring you lots of new features, so stay tuned for updates on the new UI, exciting partnerships, detailed statistics, and more!

Major Highlights

From CeFi to DeFi & Beyond: CelsiusX, Polygon, & QuickSwap

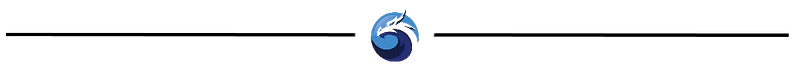

On January 12th, we announced our biggest partnership ever! QuickSwap, CelsiusX, and Polygon are coming together to revolutionise the way we think about finance. Throughout the remainder of the month, we released more details about our expanding partnership and CelsiusX’s intent to provide liquidity for three assets that had limited utility on Polygon until now. With the CelsiusX bridge, users will soon be able to transfer cxETH, cxADA, and cxDOGE to Polygon with no bridging fee. More details about the partnership and what it might include next were discussed on our star-studded Twitter Spaces with Alex Mashinsky (Celsius CEO), Sandeep Nailwal (Polygon Co-founder), Roc Zacharias (QuickSwap Co-founder), and Carl Hua (Celsius Chief Architect), which took place on February 3rd. We’ll get more into this all-star panel in next month’s newsletter. For those who want to catch up now, you can watch the replay here.

Rewards Structure Change

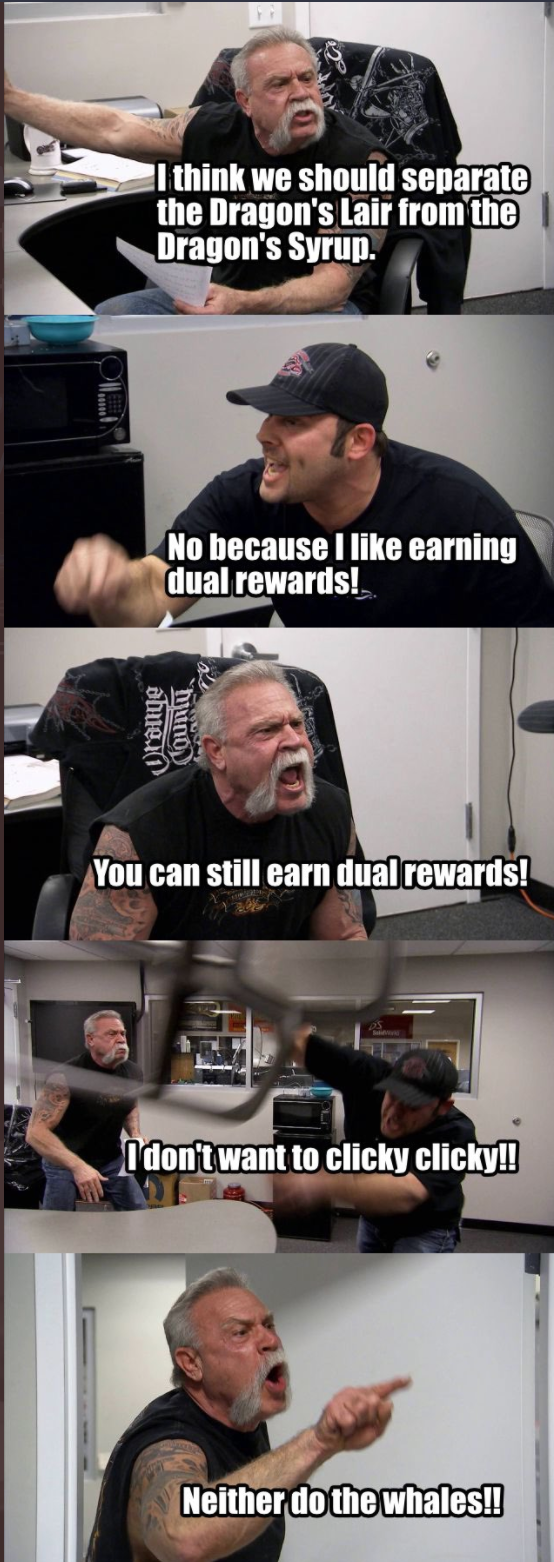

On January 1st we opened our governance discussion forum to determine whether separating the Dragon’s Lair from Syrup Pools would be a beneficial move for the community. After some initial pushback, a vast majority warmed up to the proposal, realising that it would open the gates to an entirely new realm of possibilities.

With a hoard of dragons behind us, we moved to vote. We asked all eligible QUICK holders if QuickSwap should increase stakers’ freedom by separating the Dragon’s Lair from Syrup Pools. The vote concluded on January 14th with a colossal majority of 95.64% in favor of the change.

After the vote was finalised, the change was immediately implemented although the first 3 pools under the new structure didn’t go live until January 18th. Even with the unexpected market downturn, the growth of the new pools we added this month has been steadily increasing. There are still a few of the old pools that haven’t expired, so if you want to soak up that dQUICK syrup until the last drop, you still have time!

2021: Year in Review

We published QuickSwap’s 2021 Year in Review, highlighting the many steps we’ve already taken to illuminate the path forward.

Collaborations

Quickswap teamed up with some amazing projects this month, extending your ability to buy and use QUICK. Here’s a recap of the best and the brightest we brought into the squad:

DeFiner

On January 6th, DeFiner announced that they will soon be opening a QuickSwap lending pool on the Polygon network where users can lend, borrow, and stake their $QUICK on Definer through Polygon. We can’t wait to see what added platforms that offer lending and borrowing for our favorite asset will do!

Atlantis Loans

On January 14th, Atlantis Loans enabled $QUICK enthusiasts to lend and borrow their favorite token directly on their Polygon-centric lending platform.

PolyDEX Aggregator

On January 18th, PolyDEX (a completely gasless, instant, cross-chain AMM DEX) announced that their new DEX aggregator had just launched, allowing users to get the best prices from different DEXs across the Polygon Network in one convenient location.

DeFi.org Featured QuickSwap in Launch Partner Spotlight

On January 28th, DeFi.org — the open notification protocol — featured QuickSwap in their launch partner spotlight. This incorporation enables users to set up real-time notifications to remind them about pending rewards and position worth on QuickSwap!

Community Initiatives & Outreach

QuickSwap's Community Memed Out & Won $250 in QUICK

On January 10th, we invited QuickSwap’s community to show us how they felt about our then-ongoing governance proposal to change QuickSwap’s rewards structure. Over the next 24 hours, we received several humorous responses (check them all out here). In the end, we decided that the meme posted above by ShilTelcoin best exemplified our community’s reaction to the governance discussion and proposal. He’s right! Whales don’t want to clicky clicky. Well memed Sir! Congrats on winning the $250 in $QUICK, distributed via CCTipBot.

PolygonPunks Meme Contest for NFTs

On January 26th, PolygonPunks hosted a meme contest, giving QuickSwap enthusiasts the opportunity to win one of 11 status symbol NFTs within the Polygon community. They received several impressive entries, and we’re sure the winners will be announced soon!

Media Coverage

As usual, crypto media continued to fawn over everything QuickSwap has accomplished and look forward to what is coming next.

What’s Ahead for Crypto & Blockchain in 2022?

On January 2nd, CoinTelegraph featured QuickSwap’s Co-founder and lead developer Sameep Singhania in a piece about what lies ahead for crypto and blockchain in the year to come.

Sameep said,

“I don’t have a crystal ball, so I try not to make too many predictions, but now that UniSwap has decided to launch its version 3.0 on Polygon in early 2022, major institutions are coming as well. I can’t really say much more about which ones yet, but let’s just say I expect 2022 to be another blockbuster year.”

As usual, we agree with everything Sameep said, and we can’t wait to find out more details about the other heavy hitters who are planning to come to our beloved Polygon Network this year! Read the full article here.

What were the biggest outcomes of 2021?

On January 3rd, CoinTelegraph featured QuickSwap and Sameep once again in a piece that asked 12 industry experts to weigh in on 2021’s biggest outcomes and how they affected the whole crypto industry.

In a controversial response, Sameep said,

“Bitcoin’s falling market dominance has made a bigger impact than many realize. Don’t get me wrong, I’m still a big Bitcoin supporter, but time has shown that there is room for more than one cryptocurrency….. and it’s not just ‘dumb money’ who thinks so anymore.”

Just like last time, we agree with Sameep. We all love Bitcoin, but there is room (and need) for more than one chain. Read the full article here.

Chat & Chill With Quickswap And Relay

On January 6th, Tyler and Bryant from QuickSwap’s Business Development team sat down for a live Chat & Chill Relay on Twitter Spaces to discuss the new Polygon bridge, the RELAY-QUICK liquidity mining pool, crypto’s multi-chain future, DeFi, and more.

Layer 2s are the Path to Mass Adoption

On January 12th, CoinTelegraph Magazine featured Sameep Singhania once again in a piece about why layer 2s, like Polygon, are the key to crypto adoption in emerging markets like El Salvador, and beyond.

Sameep, said,

“If I’m a normal user and I want to do a small trade, I cannot do it on Ethereum — the average transaction size on UniSwap is somewhere around $50,000.”

Singhania further explained that Polygon exists to help Ethereum scale, and while Ethereum is the most secure solution, it comes at the cost of high gas fees and slow transaction times.

It would be difficult to disagree with him there! Ethereum is great for those whose transactions are large enough to justify the high gas fees, but the majority of the world’s population needs layer 2 solutions like Polygon, and its largest DEX — QuickSwap, for blockchain to really gain adoption. Read the full article here.

How to Avoid Ethereum Gas Fees?

On January 13th, DeFiYield hosted an AMA with Sameep Singhania. Together, host Michael Rosmer and Sameep discussed Ethereum’s biggest problem, whether QuickSwap will launch on other EVM chains, the real reason for Ethereum’s high gas fees and how to avoid them. Catch the replay here.

That’s it for the Dispatch this month Draognites, thanks for stopping by. Tune in next month, we promise it’ll be a good one!

Let us know if you have any questions about any of our recent developments. Remember to follow us on social media to stay up-to-date on all things QuickSwap — Polygon’s most-established DEX.

Twitter | Telegram | Announcements | Medium | Discord| Reddit

By QuickSwap Official on February 7, 2022.

Exported from Medium on May 2, 2023.