Hello, Dragons from all corners of the cryptoverse! Welcome to QuickSwap and Algebra’s V3 on Dogechain. We’re here to help you start exploring the Dogechain universe.

As we excitedly announced in June 2022 — QuickSwap recently acquired an exclusive license to operate Algebra’s superb V3 concentrated liquidity model on Polygon and Polygon-enabled chains. With both audits now complete, QuickSwap is getting very close to implementing our V3 on Polygon. Still, before we do, we wanted to do some testing. Dogechain — a Polygon Edge chain — provided the perfect opportunity. In mid-August, our community voted to launch a bare-bones version of the QuickSwap/Algebra V3 on Dogechain, so we did.

Since launching on Dogechain, volumes have spiked, and activity is at a new high during a bear market.

Since we’ve already launched a few liquidity pools on QuickSwap’s Dogechain extension, we’ll go through the necessary steps to provide liquidity.

With every new platform comes a learning curve, but you’ll become a DogeDragon master in no time.

HINT: DogeDragon (DD) is QuickSwap’s meme token that we use for liquidity mining incentives on Dogechain.

But enough with the talk about meme coins, blockchain, and tokens. Before diving into this step-by-step tutorial, let’s clarify the main differentiators and risks for LPs using a V3.

How is QuickSwap V3 different from V2?

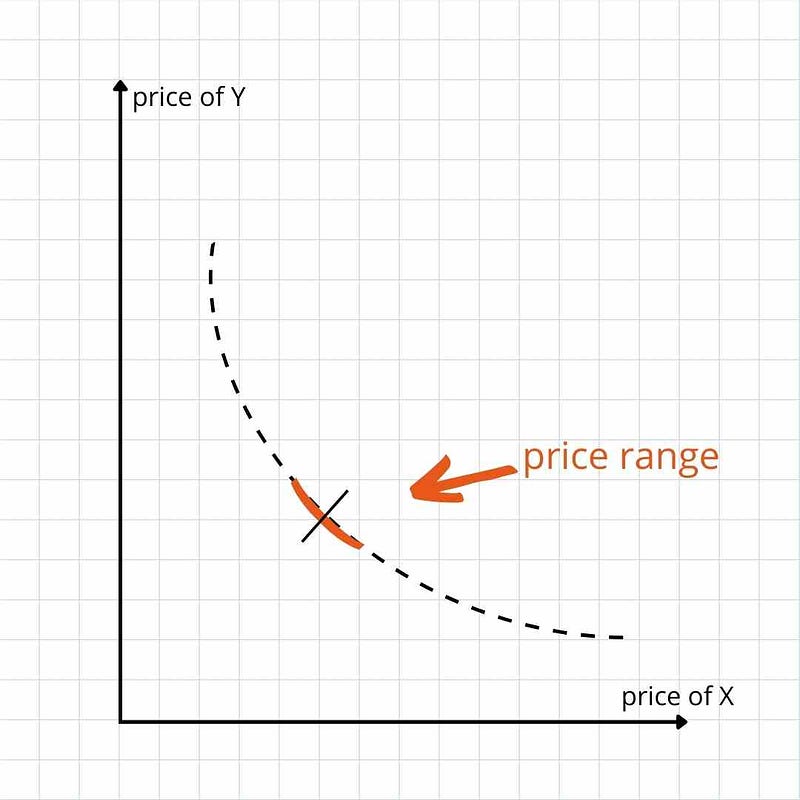

As you’ve already noticed, there’s something different about QuickSwap V3. It involves price ranges, different ratios, and risk and profit associated with your chosen price range.

The V3 model offers LPs a way to make their capital more efficient and can deliver rewards tens of times higher than the V2 model.

While this blog post isn’t meant to explain in detail how a V3 works, we feel compelled to point out the fundamental differentiators between a V2 and a V3 AMM.

- V3 allows LPs to deposit liquidity pairs in a custom price range. As the market moves, the pool will convert your liquidity position into the asset that has dropped in price (relative to the asset it was paired to). This is the real risk with V3 concentrated liquidity.

- Concentrated liquidity means LPs will receive trading fees when the assets trade within custom price ranges. This may provide traders with more significant amounts of liquidity at desired prices. Essentially, the tighter the range, the more fees you get when assets trade between that range.

- When an LP falls out of the range that LP set, s/he has a couple of options:

- Wait until the price comes back to within range, and the LP will return the original assets

- Remove liquidity and set it again with another range

- V3 LPs can provide greater depth using the same amount they would have supplied in a V2 AMM. While the risks are higher, this concentrated liquidity position supports greater trading volume. It thus earns more fees for LPs (as long as the prices remain in the set range).

- LPs construct individualized price curves that reflect their own preferences.

- Users trade against the combined liquidity of all individual curves without any gas cost increase per liquidity provider. The LPs split trading fees at a price range pro-rata (proportionate allocation) according to the amount they contributed to this range.

- Compared to V2 AMMs, LPs need to provide less capital. They can use the rest of the funds they would have used in the V2 model to hedge against downside exposure or in other investment strategies.

- Providing liquidity in a narrow price range can be similar to a traditional limit order. When the price ratio drops, the liquidity is converted into less valuable assets. Additionally, the price can not only drop, but with the increased volatility, you may also now fall out of range. The LP must withdraw the liquidity to avoid automatically converting back when the market starts moving in the other direction. Further, if the price changes within the range, your tokens may turn into another asser with the percent ratio. For example: If you had 50-/50 in the range and the price moved 2 ticks away, you would now have 70/30. The assets are only fully converted when you are completely out of the range.

- LPs should closely monitor the market price moves and update their price range accordingly to avoid liquidation.

- Theoretically, it is possible to have a lack of liquidity in a given price range.

What happens when the prices move outside the specified price range?

- The LP stops earning trading fees

- The liquidity in the pool becomes inactive

- When price moves out of range, one token fully converts to another token, depending on which side of the range the price is

Now that you know the risks of providing liquidity to a V3 AMM let’s see how LPs can use QuickSwap’s V3 on the Dogechain mainnet.

How to provide liquidity on QuickSwap’s V3 on Dogechain

Step 1. Go to QuickSwap on Dogechain

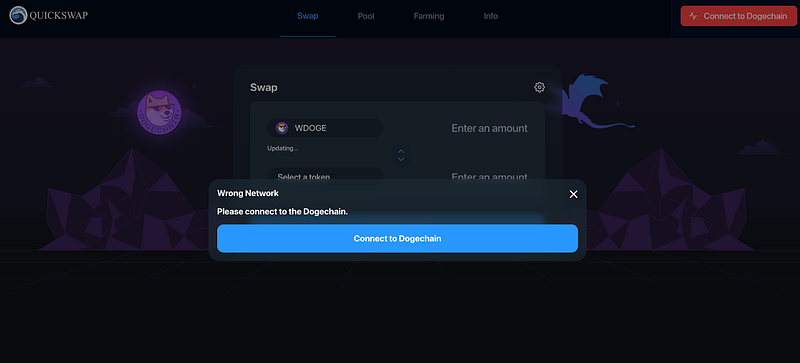

Go to dogechain.quickswap.exchange and connect your wallet to QuickSwap.

Make sure to have some funds in your MetaMask wallet. If needed, please consult this guide to deposit Dogecoin to Dogechain — How to bridge DOGE to Dogechain guide.

When you visit QuickSwap on Dogechain for the first time, you’ll be asked to change the network of your wallet to Dogechain. However, the Dogechain network will be automatically added when you connect your wallet to bridge.dogechain.dog.

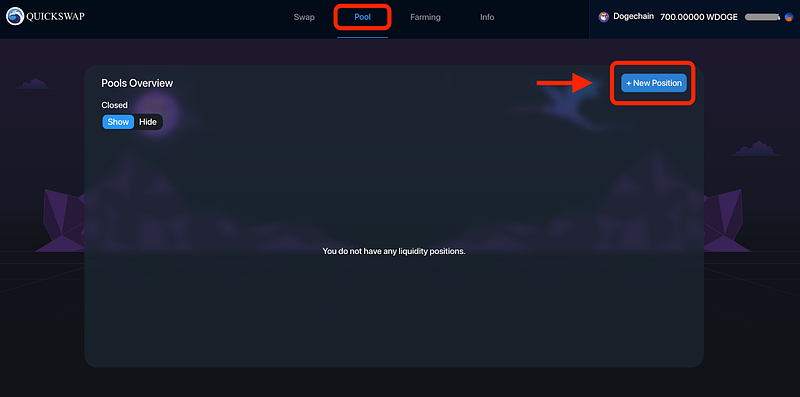

Step 2. Go to Pools

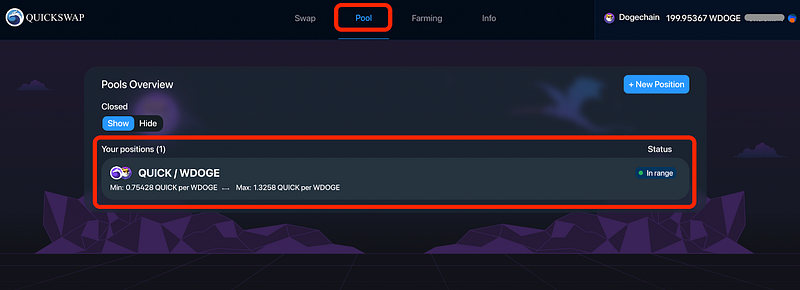

Considering you have an equal amount of the two assets in your wallet, open the “Pool” tab and click on “+ New Position.”

Step 3. Select assets to provide

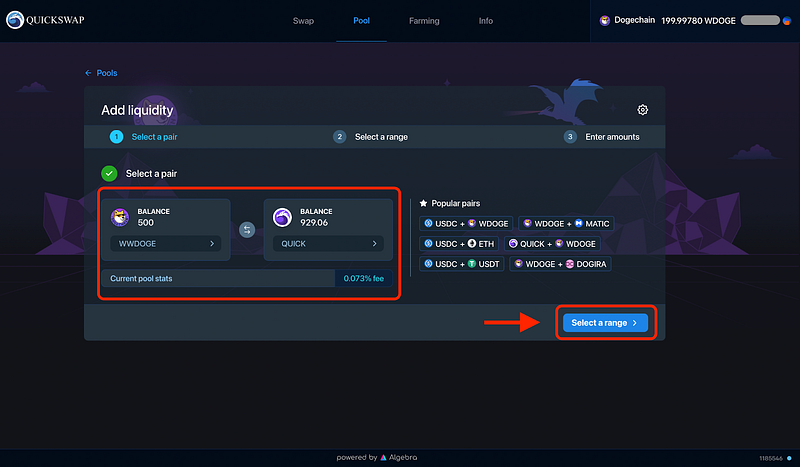

You can provide any pair as liquidity on QuickSwap V3 on Dogechain, but for this example, we will provide QUICK / wwDOGE.

Please note that you will need to also bridge QUICK tokens to your Dogechain wallet. Here’s a tutorial on how to “Bridge New QUICK from Polygon to Dogechain.” Of course, you may use this bridge to deposit other coins and tokens to Dogechain.

IMPORTANT NOTE: wwDOGE is not wDOGE! While the two tokens are different, for farming, they are interchangeable. If you have 50 wDOGE and 50 wwDOGE, and you want to add 100 wDOGE to a liquidity pool, you must convert one token into the other using the “Swap” function.

We will select our two assets in the “Add Liquidity” window. In this case, wwDOGE and QUICK.

Step 4. Select price range

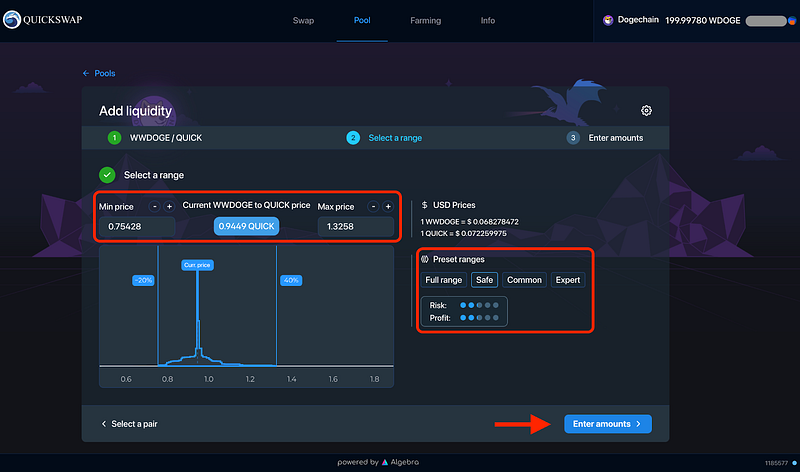

This is a crucial differentiator between V2 and V3 AMMs.

We strongly advise anyone looking to become a liquidity provider on a V3 AMM to research the implications of the rewards and the associated risks in more depth.

In a nutshell, the V3 AMM will let you provide liquidity in a selected price range.

Notice that there are four predefined ranges — full range, safe, common, and expert. Under them, you will see a ranking (from 1 to 5) of the associated risk and profit.

Of course, you can manually adjust your price range by typing in a minimum and a maximum price for your asset.

Step 5. Select amounts

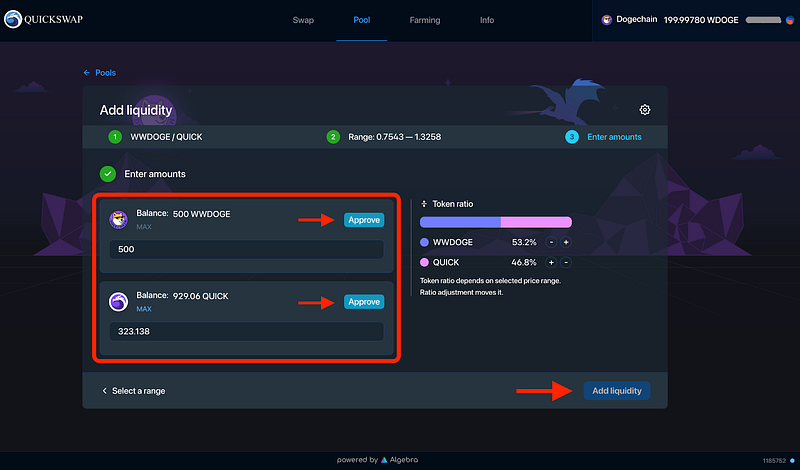

Note that the token ratio depends on the chosen price range. Therefore, you can adjust the ratio manually, which will readjust your price range.

Before adding the liquidity, you must approve each asset by signing a transaction with your MetaMask wallet. Luckily, the gas fees are low. In this case, the Dogechain gas fee for approving one asset was only 0.002667 wDOGE.

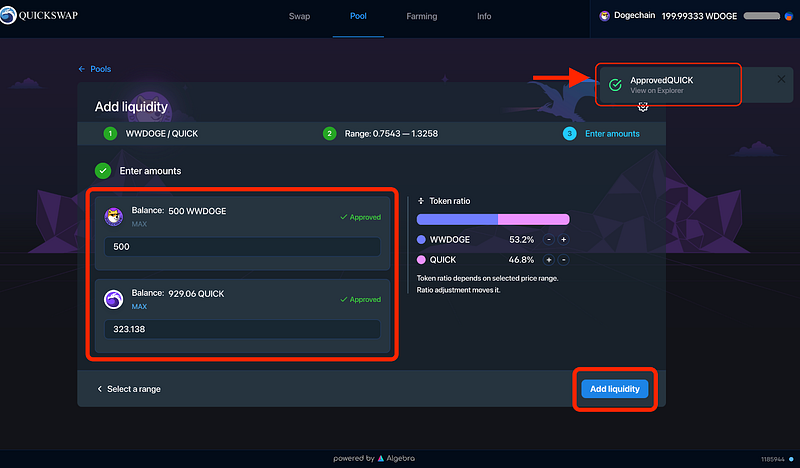

Step 6. Add liquidity

After you approve both assets, you are ready to provide liquidity on QuickSwap V3 on the Dogechain mainnet.

After you’ve confirmed all the deposits from your wallet, you will also get a confirmation from the QuickSwap app, and you will be able to see your pools on the “Pool” page.

Congrats on providing liquidity on the QuickSwap V3 app on the Dogechain mainnet. All you have to do now is wait to claim your fees.

We hope this tutorial will help you get started as a V3 liquidity provider on QuickSwap’s V3 on Dogechain. Please share your experience as a V3 LP on QuickSwap in the comments or on social channels.