Dragonites, today we are excited to discuss with you the possibility of implementing the most significant upgrade in QuickSwap’s history. We are ready to take an incredible step forward in our evolution to remain the number one DEX on Polygon. Are you, the QuickSwap community, ready to take the next step forward with us?

UniSwap’s V3 DEX model — with lower trading fees and concentrated liquidity pools — has proven to be the most efficient DEX model to date. We’re ready to compete and take our volume back as well as corner a larger share of the overall market from other competing DEXs. To do this we’ve been working quietly in the background to launch our own concentrated liquidity model. We come to you today to discuss the official acquisition of the license for this V3 protocol, which we believe will make us stronger than ever.

TL; DR:

- DeFi moves fast. Automated Market Maker (AMM) V2 DEXs are becoming obsolete in the face of new more capital-efficient models.

- QuickSwap would like to acquire a V3 protocol’s code license and shift to this new concentrated liquidity paradigm.

- We’ve negotiated terms with what we believe is a stellar protocol.

- We need up to a maximum of $350,000 from the treasury to pay for two audits (it could be less than this, this is the maximum possible)

- This acquisition will help QuickSwap regain most of the volume we’ve recently lost to competitors.

- Additionally, this will distribute capital more efficiently within the Polygon ecosystem and provide better liquidity and access to dynamic fees that fluctuate based on volatility.

- We value your input, which is why we’re introducing this discussion before conducting a governance vote.

- We would like to move quickly and we hope to pass this proposal so that we can start regaining some of the volume we’ve lost to competitors.

- Please read through this entire post carefully before forming an opinion.

- Once you’ve read through, visit our Reddit discussion forum to ask any questions and/or discuss with the community: https://www.reddit.com/r/QuickSwap/comments/vgzzkl/governance_discussion_should_we_move_forward_with/

- We’re running a simultaneous discussion about introducing an isolated lending and borrowing market to increase yield opportunities and create additional revenue. Read more about that here.

Acquiring a V3 Protocol

For many months, QuickSwap has been in discussions about the acquisition, adoption, and integration of an exclusive license to utilize a V3 software on Polygon and all future Polygon-enabled chains. We have now come to an agreement, and we need your vote to move forward.

V3 Dexs are the future of DeFi

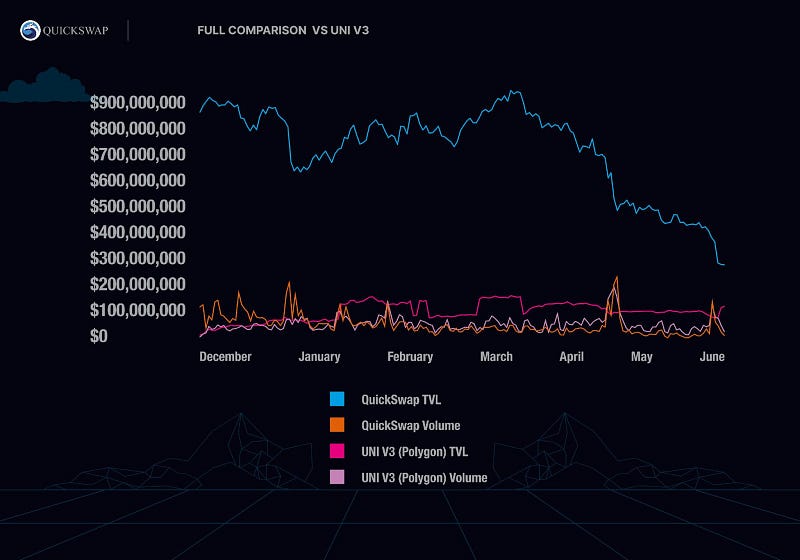

The chart above compares QuickSwap’s TVL and daily volume with UniSwap’s TVL and daily volume on Polygon. While trading volumes across the two DEXs move somewhat in tandem, UniSwap is gaining on QuickSwap as many users prefer lower trading fees. The chart also shows how a V3 can do more volume with a fraction of the liquidity.

While we can’t blame people for using the most efficient tools the market has to offer, we won’t sit idly by and watch unicorns eat dragons. That’s why we’d like to acquire this license to operate and continue to develop our own V3 and potentially V4 moving forward (This is already in process). To do that, we need to complete a series of audits on the V3 software. We estimate that these audits will cost between $250,000 to $350,000. If the proposal to pay for these audits from our treasury is approved, we will convert smaller portions at a time to stables via an OTC desk to pay for the many pieces of the audits over the next 45 days. Any money remaining after the audits are complete will be returned to the treasury. In addition to paying for the audits, QuickSwap has also agreed to pay a portion of all V3 trading revenue to the V3 developers whom we are working with (more on that below).

Timeline

As a community-governed DEX, the first step in any major change is to discuss it with you — our community. If you like the idea, we’ll move to the next phase — a governance vote. When it comes to the V3, we’re hoping to move through the discussion and voting phases quickly so that we can begin the process of auditing and have the V3 implemented in Q3 of this year. Note: QUICK holders always make the final decision.

How would the V3 work?

Dynamic Fees

The V3 protocol that we would like to acquire uses concentrated liquidity, similar to UniSwap V3, but may be more efficient because it offers dynamic fees that adjust based on volatility. Instead of the 0.3% trading fee V2 DEXs charge, our V3 DEX will offer variable rates. We anticipate the average swap on our V3 DEX will be between 0.1%-0.15%. When traders swap from one stable to another stable, the fee will be low because they aren’t volatile assets, but when traders swap between more volatile assets, the fee will be higher to decrease the risk of Impermanent Loss (IL) for liquidity providers.

UniSwap V3 focuses on the trader, so many liquidity providers experience IL during volatility. One study showed that 53% of LPs lost funds on UniSwap V3 in an analysed time period. In the model we will use, dynamic fees find the best balance between the trader and the liquidity provider. Theoretically, it should be more efficient than Uni V3. Traders will pay less fees when the market is stable, during more volatile times, trades may be routed through our V2 pools, which are explained more in the section titled “QuickSwap Aggregator” below.

Fee Breakdown

If this governance proposal is approved, QuickSwap estimates that the average trading fee on our V3 will be between 0.1% and 0.15% per trade. Due to the fact that our new V3 fee structure is dynamic, it’s difficult to do an apples-to-apples comparison of our V2 vs V3. The new way to understand the fee split is as follows:

- 90% will go to liquidity providers

- 6.8% will go to the Dragon’s Lair

- 1.7% will go to the QuickSwap Foundation

- 1.5% will go to the V3 developers

- Note: 6.8%:1.7% is a 4:1 ratio, which is the equivalent ratio of the 0.04%:0.01% which goes to the Dragon’s Lair and Foundation at present

While we kept the ratio between how much will go to Dragon’s Lair stakers and the QuickSwap Foundation the same, it is worth noting that with a V3, both will receive less per trade. To stay competitive, we have to give more to liquidity providers as well as lowering overall trading fees. This is the direction the industry is going, and we must stay competitive if we want to win the Polygon DEX wars. Additionally, because our V2 will continue to operate alongside our V3, the volume traded on our V2 will continue to be distributed at the current rates.

QuickSwap Aggregator

If this proposal were to pass, we anticipate the V3 audits will be complete within 30 days and integration will be fully complete sometime in Q3 of this year. Once we get the V3 up and running, swappers won’t even know whether they’re using V3 or V2 because of the aggregator we’re developing.

Liquidity Providers will choose between providing liquidity to V2, V3, or both. Those who prefer to take a less active role in managing their liquidity will likely continue to LP on V2, but trades will automatically route through the best option, whether that’s using V2, V3, or both. We expect that larger trades will likely be routed through both as they multipath through multiple pools.

Our aggregator strategy has many advantages, including:

- Routes through V2 or V3 depending on which has the best pricing through a combination of lowest fees, slippage, highest TVL, and arbitrage differences

- Multi pathing — it can use both V2 and V3 in a single trade

- Smart pathing — it can use multiple V2 and V3 pools all in one trade. A single trade may use 2 or 3 pools from V2 and 2 or 3 pools from V3 all in one trade to get the most efficient, lowest fees, and lowest slippage trades. This will significantly improve the trading experience and cost of using QuickSwap which will bring us potentially many multiples of volume.

How would the V3 acquisition affect me?

Although introducing a V3 model will decrease revenue per trade on trades routed through the V3 pools, we believe that we’ll more than makeup for it with increased volume over time — as UniSwap has already proven. With a fee structure more similar to UniSwap’s model, concentrated liquidity’s capital efficiency, high TVL, dynamic fees, QuickSwap’s amazing community (more daily users than most projects in the entire world), and a ton of features that our competitors won’t or don’t offer, QuickSwap will reign supreme on Polygon, but we can’t do it without you!

We expect that in time, V3 will replace V2 almost entirely, and DEX swappers won’t know the difference, except that they will receive better rates and lower trading fees per trade. Liquidity providers, however, will definitely have a different experience because V3 requires active money management, which is fairly advanced for many users. For some time, average liquidity providers will likely stick to V2 until much of the volume moves to V3 and people are forced to learn how to use it. If this governance proposal passes, QuickSwap will create guides and tutorials on how to use our V3. Additionally, we are in discussions with projects who are building concentrated liquidity management tools to further automate the process. In the future, we believe that most DEXs will use concentrated liquidity + liquidity management tools and DAOs.

Why do audits cost so much?

$350,000 is a lot of money. We understand that, and we don’t disagree. Smart contract auditors are in high demand now as DeFi users increasingly insist that protocols ensure their security. Audits require a team of specialist developers to comb through and battle test the protocol’s code. The V3 license we’re hoping to acquire has quite a lot of code. We anticipate that the audits will cost around $350,000. If we are able to get the audits completed for less, we will return the remainder of the funds to QuickSwap’s treasury.

What’s next?

Be sure to visit our Reddit discussion forum as your favorite team and community talk through the possibilities. If the community seems on board with the acquisition, we’ll release a formal governance vote in a few days. If that vote passes, QuickSwap will initiate the necessary audits immediately. We will plan to implement the V3 in Q3 of 2022.

Don’t forget that we’re also running a simultaneous discussion (and hopefully vote) about the possibility of introducing an isolated lending and borrowing market natively on QuickSwap. This would increase yield opportunities and create an additional revenue stream for QUICK stakers and the QuickSwap Foundation. Read that blog here, then join the discussion.

Twitter | Telegram | Announcements | Medium | Discord | Reddit

By QuickSwap Official on June 21, 2022.

Exported from Medium on May 2, 2023.