In June 2022, our community of Dragons voted in favor of acquiring an exclusive license to operate Algebra’s V3 concentrated liquidity model on our DEX. You can find all the details here: “Let’s Do Algebra on QuickSwap.”

The first QuickSwap V3 was already deployed on Dogechain. We have now released it on Polygon.

In this guide, we will explain everything you need to know about how to swap, provide liquidity, and farm on QuickSwap’s V3 on Polygon. Ready, set, go!

Those who prefer video content, may find our tutorials in this Twitter thread useful.

QuickSwap V3 is different than QuickSwap V2

Firstly, let’s make sure you understand the main differences between the two versions and how they may affect your liquidity — because it’s quite different, and you might be surprised when your holdings change proportions.

- V3 allows LPs to deposit liquidity pairs in a custom price range.

- Concentrated liquidity means LPs will receive trading fees when the assets trade within custom price ranges.

- When an LP falls out of the range that LP set, the liquidity provider has two options:

- Wait until the price comes back to within range, and the LP will return the original assets

- Remove liquidity and set it again with another range

- V3 LPs can provide greater depth using the same amount. This means that less liquidity will accumulate greater rewards from trading fees.

- LPs construct individualised price curves that reflect their own preferences.

- Users trade against the combined liquidity of all individual curves without any gas cost increase per liquidity provider. The LPs split trading fees at a price range pro-rata (proportionate allocation) according to the amount they contributed to this range.

- Compared to V2 AMMs, LPs need to provide less capital.

The most important aspect when providing liquidity on QuickSwap’s V3 is that your assets will get converted as the prices move!

When the price ratio drops, the liquidity is converted into the less valuable asset.

Additionally, the price can drop, and with the increased volatility, you may now fall out of range. The LP must withdraw the liquidity to avoid automatically converting back when the market starts moving in the other direction. Further, if the price changes within the range, your tokens may turn into another asset with the percent ratio.

For example: If you had 50-/50 in the range and the price moved two ticks away, you would now have 70/30. The assets are only fully converted when you are completely out of the range.

As you’ve already noticed, there’s something different about QuickSwap V3. It involves price ranges, different ratios, and risk and profit associated with your chosen price range.

The V3 model offers LPs a way to make their capital more efficient and can deliver rewards tens of times higher than the V2 model.

Now that you understand the core differences between the two models of AMMs, let’s see how QuickSwap’s V3 works for swapping, providing liquidity, and farming.

How to swap on QuickSwap’s V3

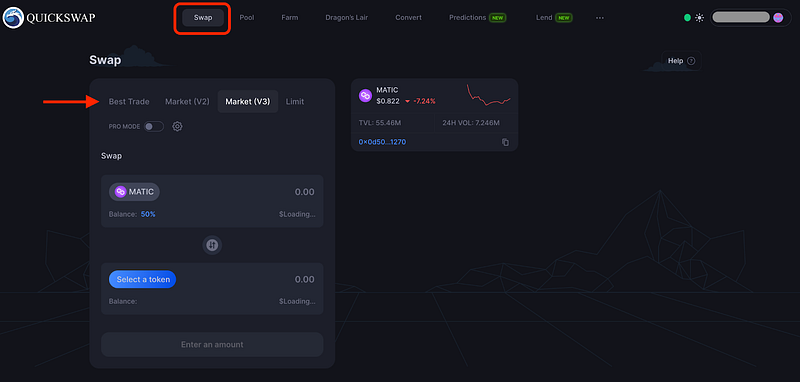

Step 1. Go to the Swap page on QuickSwap

Go to QuickSwap’s V3 Swap page. To ensure you get the best possible trade route. For this, you will have to choose “Best Trade.” By choosing the Best Trade option, your swap will use the most efficient path given all the available liquidity pools.

If you were to choose Market V3, the exchange would use only V3 liquidity for your swap. As we are just rolling out the V3 model, there might be insufficient liquidity to perform your swap.

Step 2. Select V3 market and assets to swap

To use the V3 AMM for swapping your assets choose Market (V3).

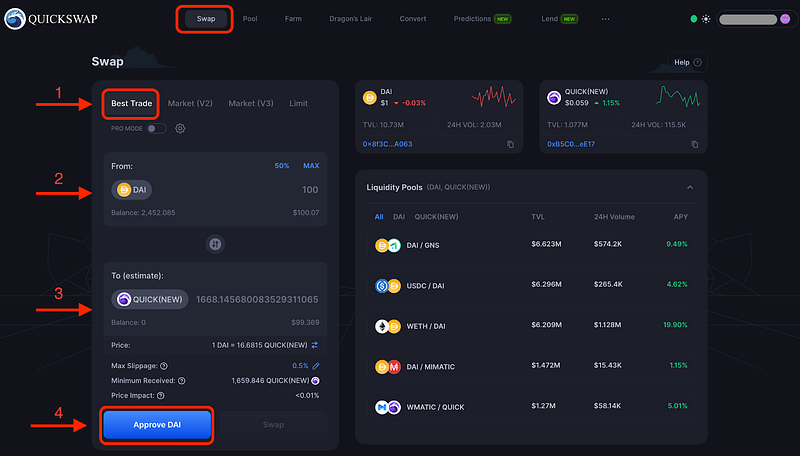

Select your assets to swap and type in the amount. In this example, we will swap DAI for QUICK.

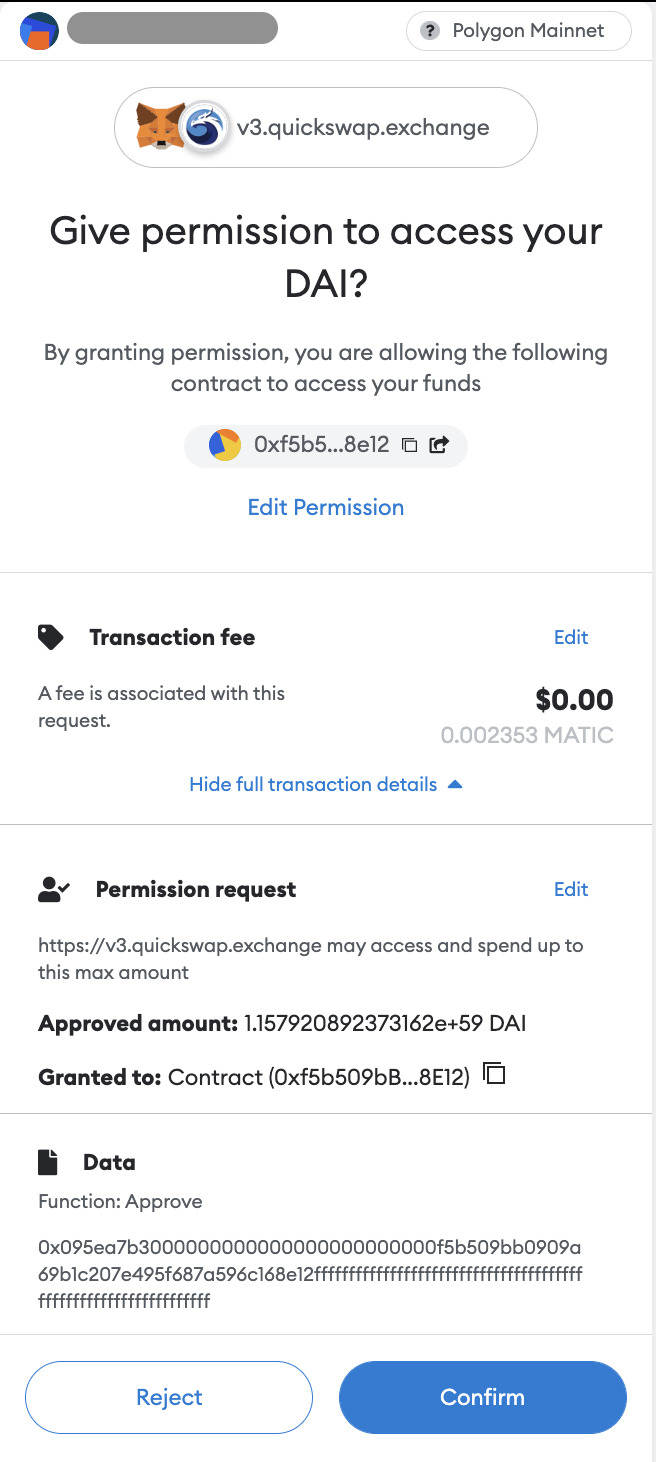

After choosing your assets, you will have to allow QuickSwap to access your assets by confirming the transaction from your wallet. Click on “Approve” and them click on “Swap”.

The wallet confirmation should look something like this:

Go back to QuickSwap and click on “Swap” to complete the exchange.

Step 3. Complete the swap

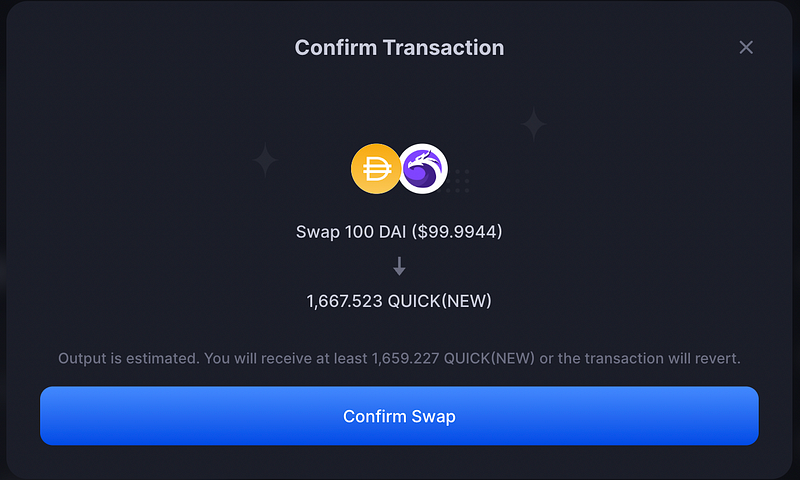

A pop-up window will appear to ask you to confirm the swap.

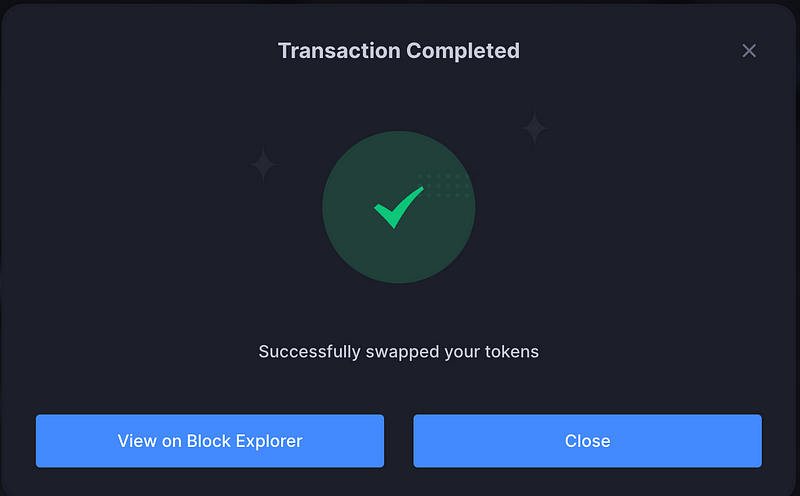

After you click on “Confirm Swap” you will be prompted to confirm your transaction from your wallet. Once more, you will have to confirm the transaction from your wallet. You will shortly get a confirmation from QuickSwap saying that your transaction was completed.

How to provide liquidity on QuickSwap’s V3 on Polygon

Step 1. Go to QuickSwap V3

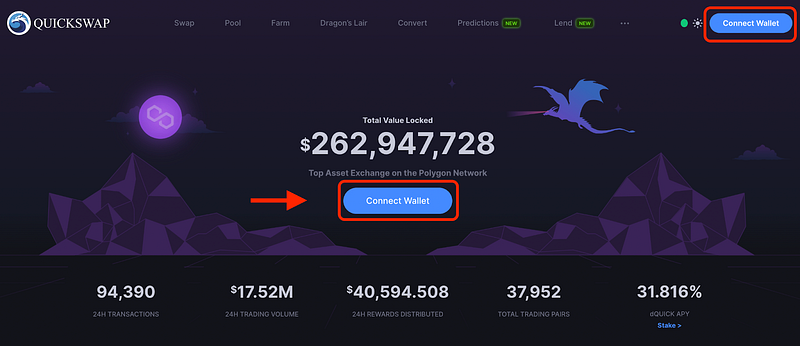

Go to https://quickswap.exchange/#/ and connect your wallet.

Step 2. Go to Pools

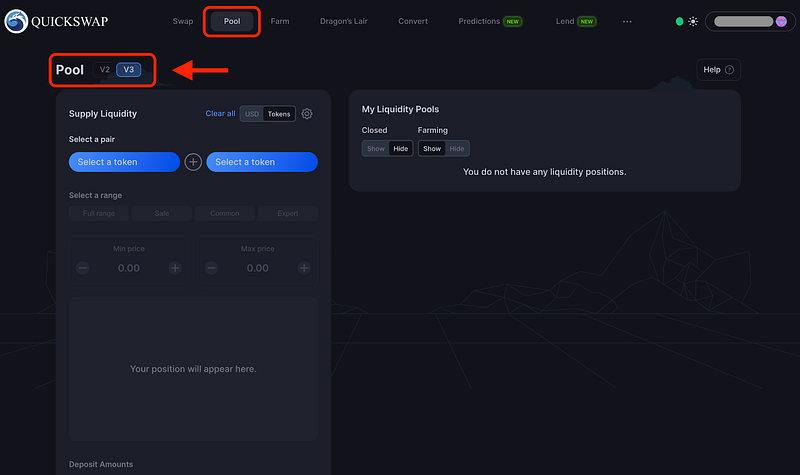

To provide liquidity on QuickSwap’s V3, you need to go to the Pool page from the top menu.

Note that you may select the liquidity model you want to use on this page. Select the V3 pool for providing concentrated liquidity on QuickSwap V3.

However, each LP is free to choose the desired model to use for their liquidity, and you can easily switch between V2 and V3.

Step 3. Select assets to provide

You can provide any pair as liquidity on QuickSwap V3.

When creating a new LP pool, you may encounter two different situations. As we are launching the V3, there will be fewer V3 pools, and when creating a new pool, you might need to manually set the price ratio correctly. After some time, as more pools are created, the price ratio will be automatically fetched by QuickSwap V3.

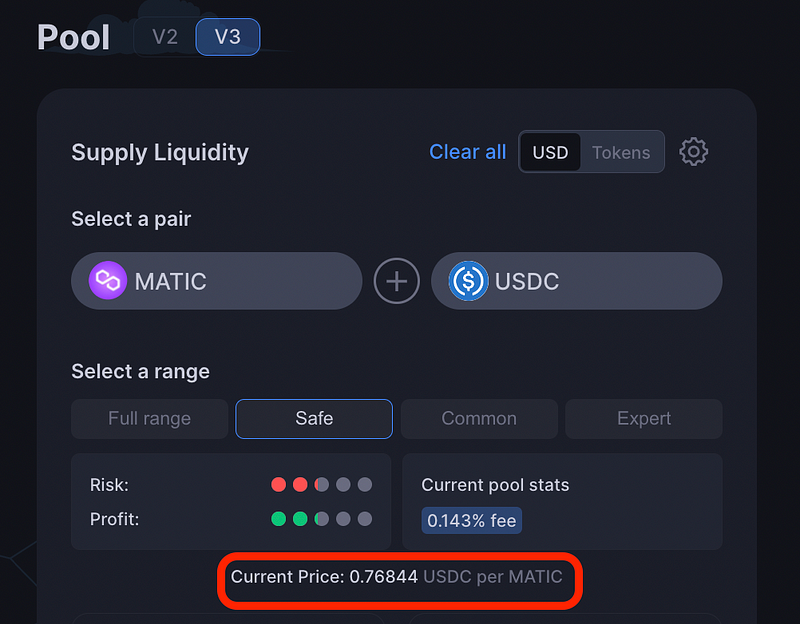

- LPs pool will auto-fetch the price ratio for your assets

Most likely, this will be the case when you are using QuickSwap V3 to deposit liquidity. The price is automatically fetched, and you just have to select the range for your concentrated liquidity.

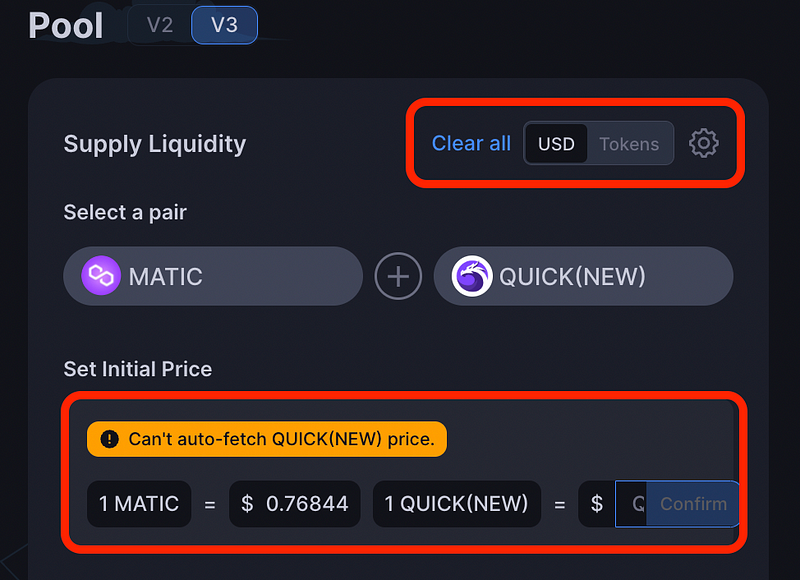

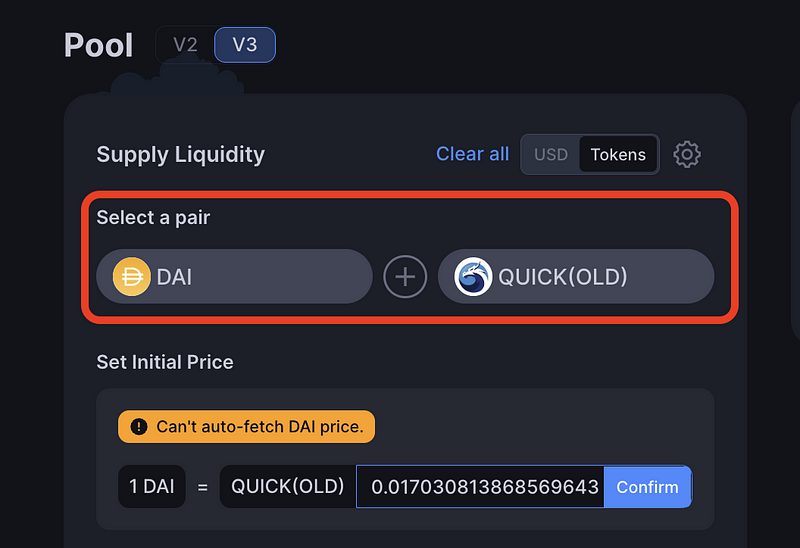

2. Manually set the price ratio for new LP pools

When no price relation exists on the V3, the exchange will not be able to calculate the price correlation between the two assets automatically. In this rare case, you must manually type in the value. Over time, as more LP deposits are created, the platform will automatically fetch the price ratio for most assets.

If you’re the first liquidity provider for this pair of assets, you might get the following message — “Can’t auto-fetch X price.” This message is displayed when there is no way to auto-determine the price ratio between the two assets. If, for instance, there are pools for MATIC/USDC and QUICK/USDC, then the V3 would automatically fetch the MATIC/QUICK price ratio, even if there is no such pool.

Have you noticed the small “USD/Tokens” toggle on top? You may choose how to express the price ratio between the two assets for your V3 LP.

- If you choose “USD” — you may express the assets’ prices in USD, which is probably the easiest way to do it.

- If you choose “Tokens” — you will have to express their correlated price. You may use the Swap page to get the correct value for your assets.

Step 4. Put in details for your LP (range, amount)

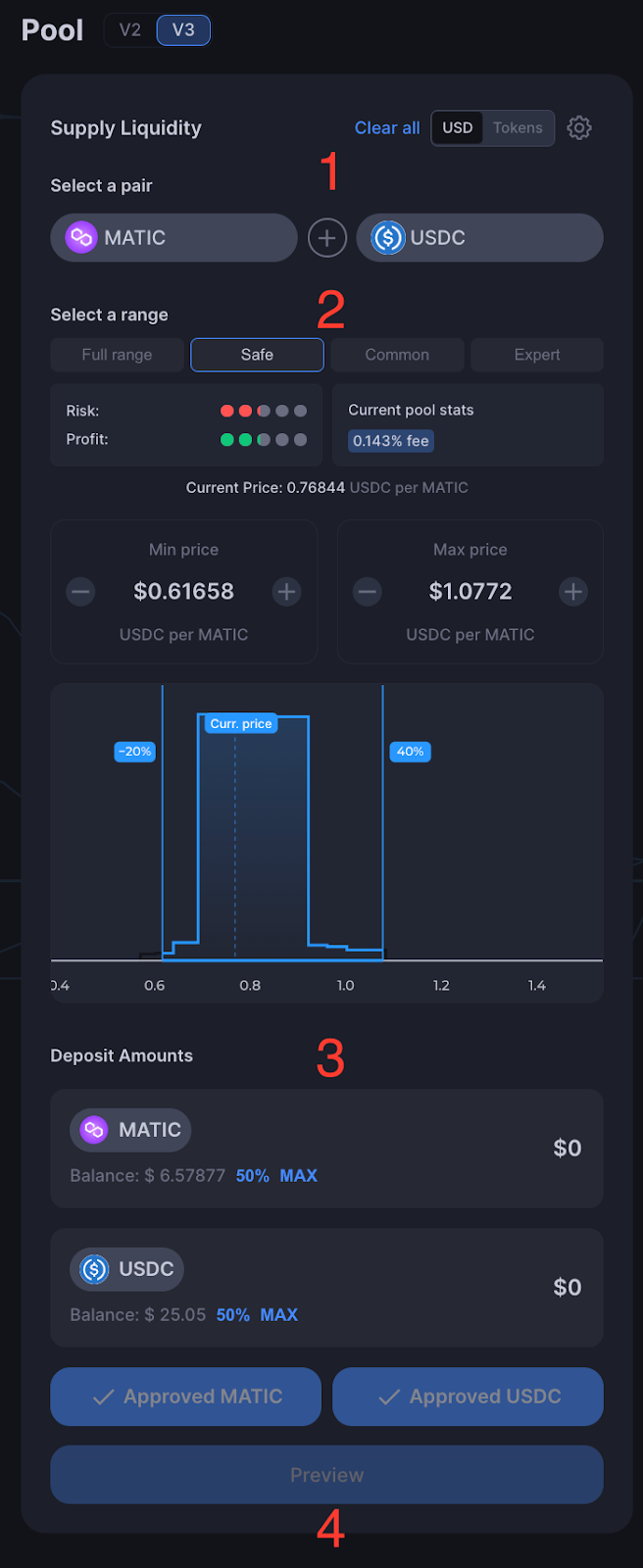

After deciding on the assets to provide liquidity to QuickSwap’s V3, you must carefully set all the conditions for your concentrated liquidity.

As you can see in the picture, you have to set the following:

- Choose the two assets. You may also need to define the price relationship between the two assets, ONLY if the platform can’t auto-fetch the price ratio. See step 3b.

- Set the price range for your concentrated liquidity. You may choose between the predefined ranges (Safe, Common, or Expert) or manually input your custom range.

- Select the amount to deposit.

- Approve both assets from your wallet and confirm the deposit.

If you set a price range that doesn’t correspond with the current market prices, you will get the following warning:

Step 5. Supply the liquidity pair

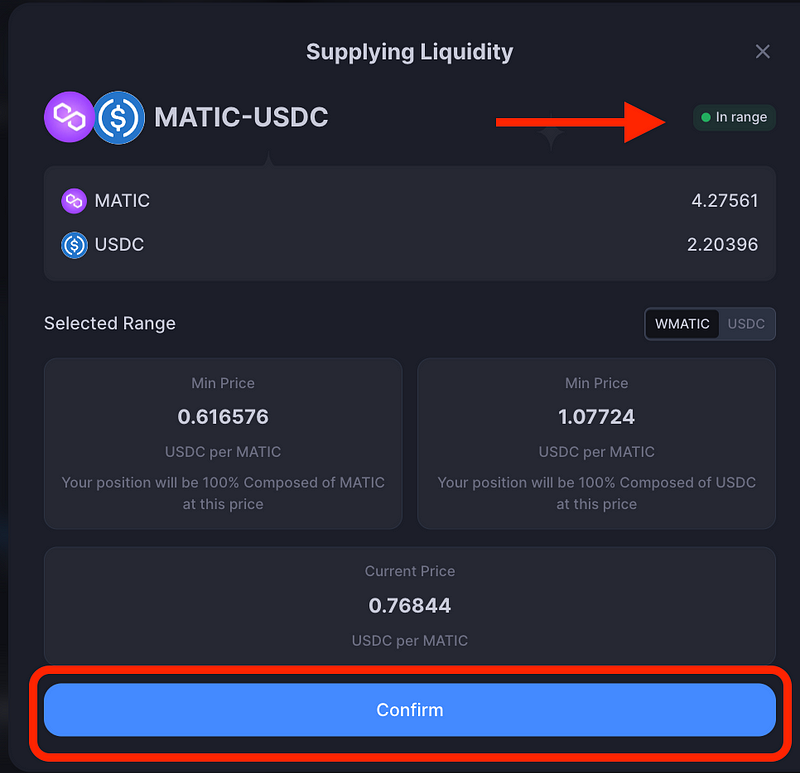

After approving the two assets from your wallet, confirm the deposit of the pair. Click on “Preview” and then “Confirm” and proceed to confirm the transaction from your wallet.

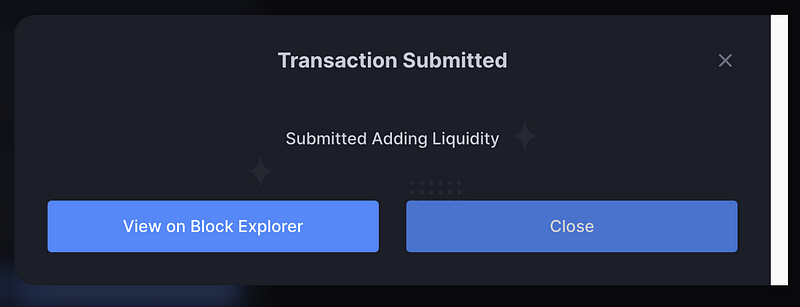

You will get a confirmation from QuickSwap after successfully depositing the liquidity.

And that’s it! You can now find your liquidity on the Pool page on the V3 version of QuickSwap.

Step 6. Manage your LP position

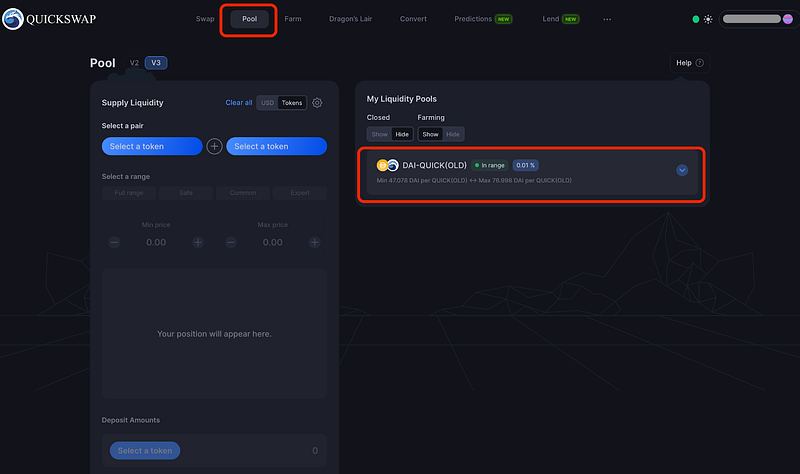

You will now find your LP under “My Liquidity Pools” on the Pool page. To see the V3 pools, you must choose the V3 Pool page.

Here, you can see at a glance if your LP is in range. Please remember that V3 LPs should be closely monitored and managed, as they might get out of range if prices shift.

When that happens, you may withdraw the LP and create a new LP for the new price range. Of course, you can also choose to wait for the prices to shift back.

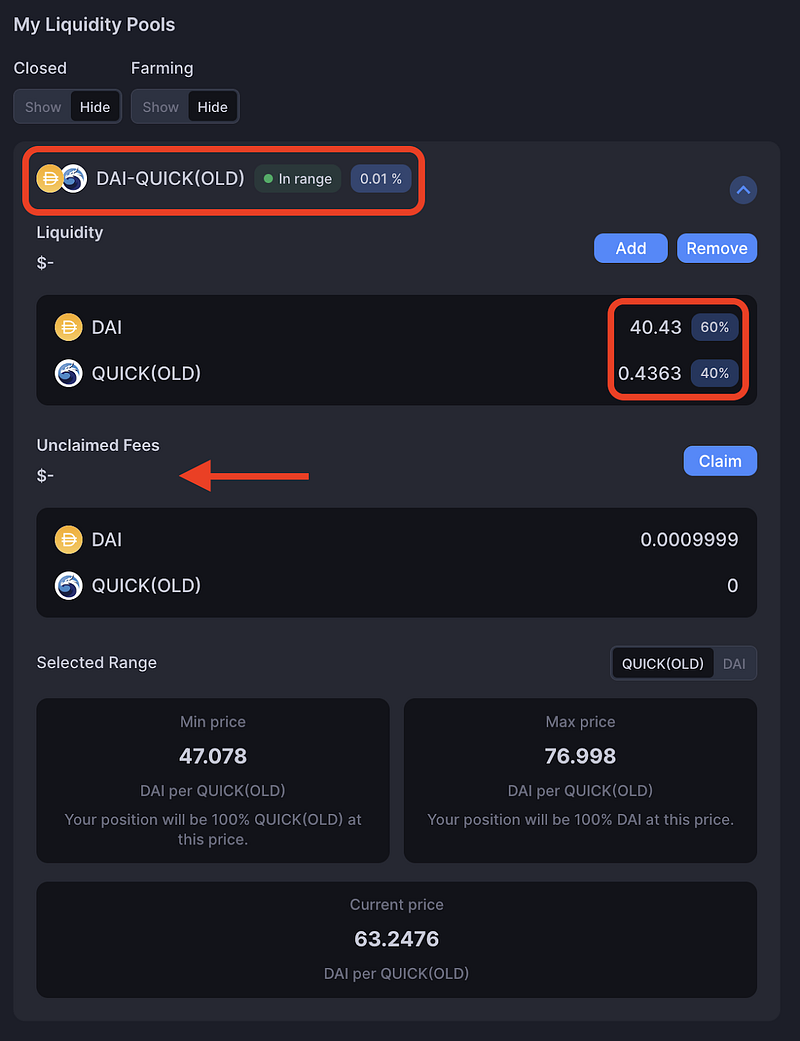

To see more details about your LP, click on the small arrow on the right.

In this window, you will see whether the LP is in range, the currency percentage of each asset for your LP, and the unclaimed fees. In this example, we have no fees, as we just provided the LP, but this changes as the LP is used for V3 swaps.

You may add more liquidity to your position or completely remove it at any time.

Happy LP-ing Dragons! May QuickSwap’s V3 concentrated liquidity AMM bring you all the desired rewards!

How to Farm on QuickSwap’s V3?

You may also farm your LP tokens on QuickSwap’s V3, but there’s a twist.

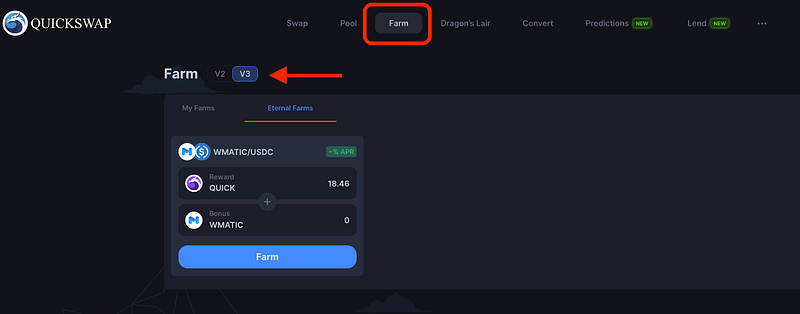

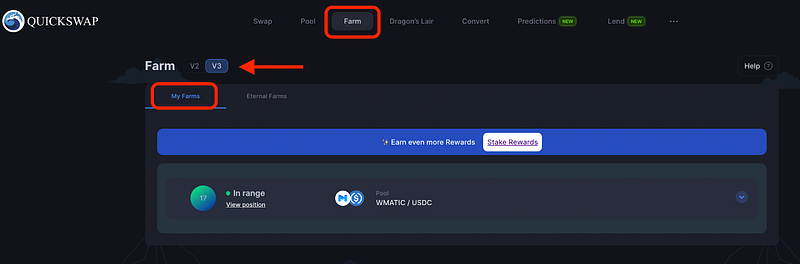

Step 1. Go to V3 Farms

Firstly, you need to go to Farms and select the V3 version. More farms will be added under Eternal Farms, but right now, we only have the WMATIC/USDC farm. You need to provide LP for this pair to participate in this farm.

It’s important to note that on the V3 model, LPs receive an NFT to represent their LP position. On V3, there is no such thing as V2 LP tokens. To participate in one of these Eternal Farms on V3, you will use that NFT to the QuickSwap V3 smart contract.

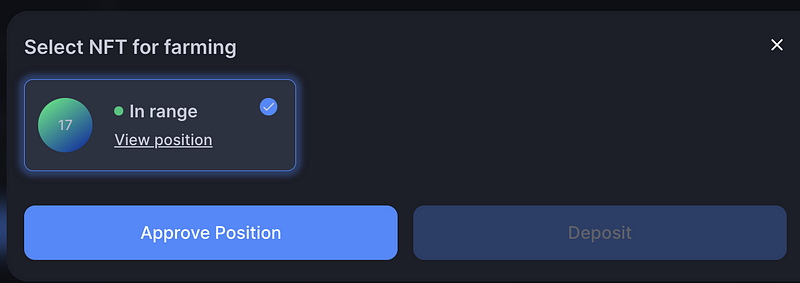

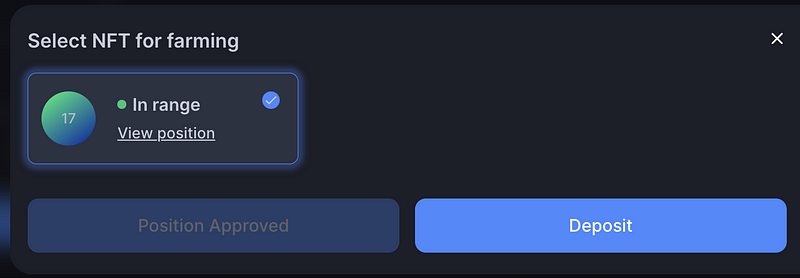

Step 2. Select farm and deposit NFT

After you click on “Approve Position,” you will also have to confirm it from your wallet.

You can now deposit your NFT for farming on QuickSwap’s V3.

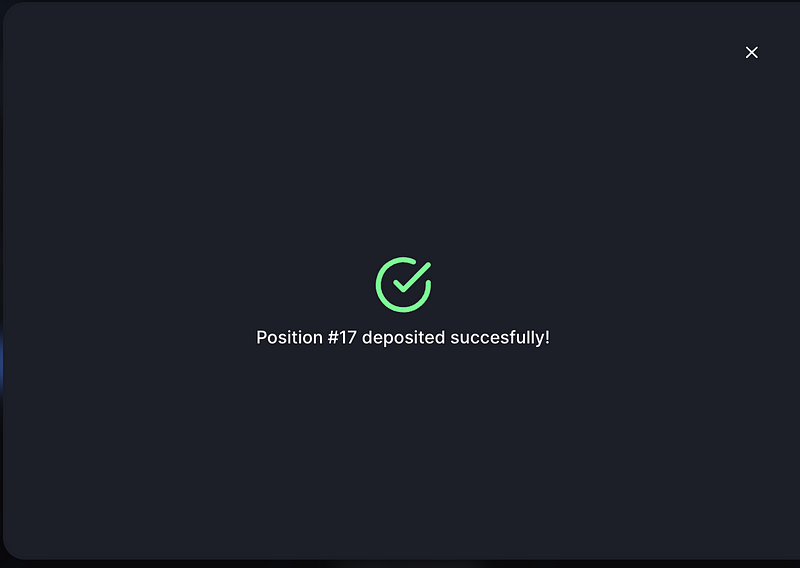

After confirming the transaction from your wallet, you will get a confirmation from QuickSwap.

Step 3. Check your V3 farms

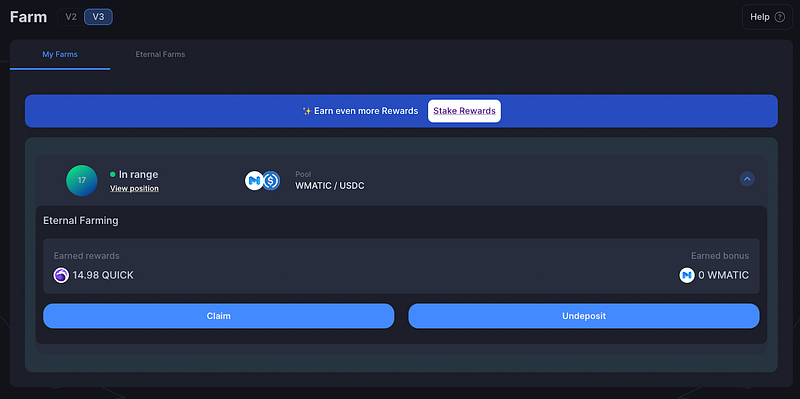

You will now find all your farm under Farm. Select the “My Farms” section.

You can see whether or not your deposit is in range. Click on the small arrow to see more details about your farm.

You can Claim your rewards or withdraw your deposit at any time.

And that’s how you farm on the new V3 model on QuickSwap.