Note: This governance proposal has been written by the Protofire and Atomica team - QuickSwap is posting the proposal, discussion, and formal vote on their behalf.

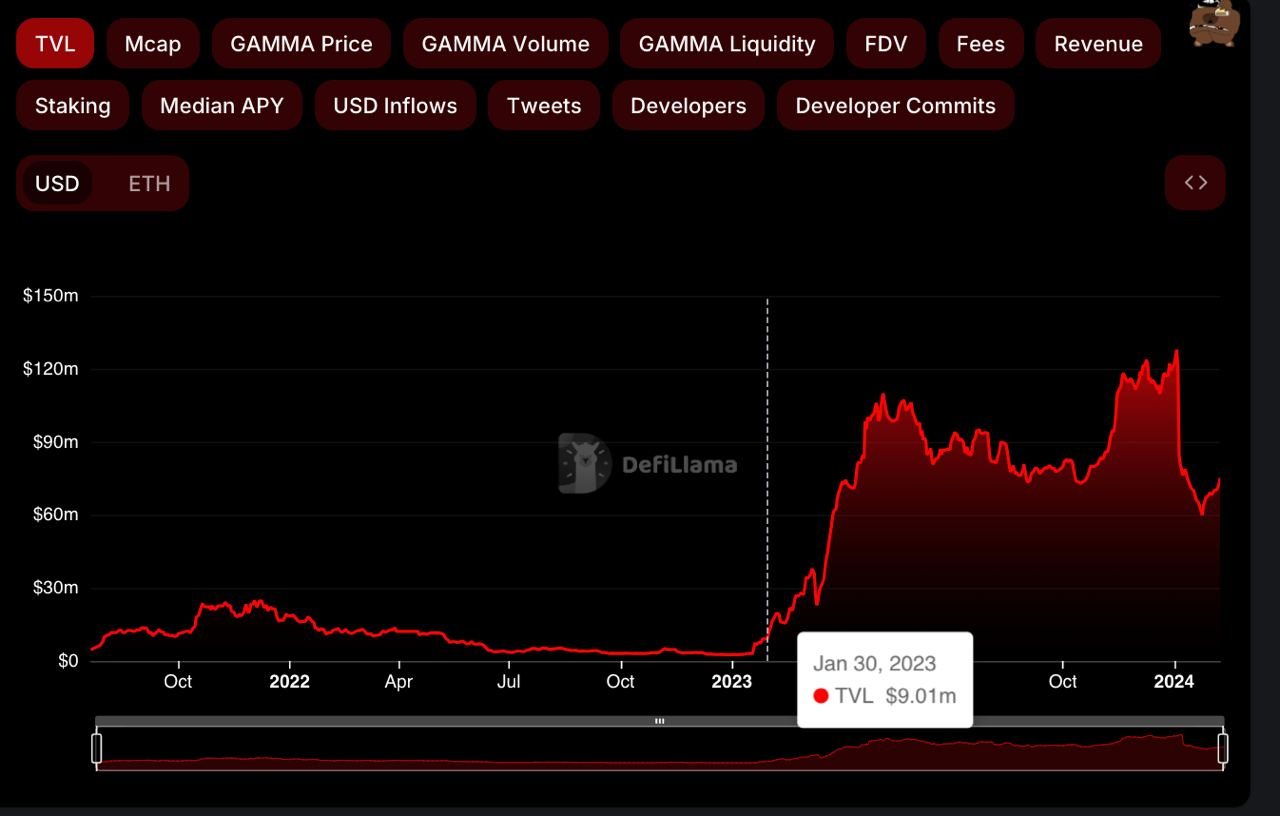

The Protofire & Atomica team is proposing a grant to build a Staking Protection solution that could potentially improve user confidence and safety - this could result in increased users and TVL (Total Value Locked).

Voting yes to this proposal will result in:

- The transfer of $15,380.00 from the QuickSwap DAO treasury to Atomica / Protofire to pay for the development of the Staking Protection protocol for QuickPerps

- Featuring Protofire on QuickSwap’s website

What is Atomica?

Atomica is an algorithmic protocol, incubated inside Protofire, built for Web3 solutions and investors to launch their protection cover markets, offer protection to their users, or on the other side earn a yield on their capital for providing said protection. Its mission is to provide financial flexibility and reduce risk for our users by offering a range of protection cover options and underwriting capital for liquidity providers.

What is Protofire?

Protofire is a Service DAO, working with many large L1/L2 networks and DeFi protocols, building features that deliver a competitive advantage to its partners and users. Some of the recent grants received by Protofire, and what they delivered, include

- Grants from Ethereum Foundation and Optimism in 2022 and 2023 to develop and maintain Solhint, the most adopted Solidity linting tool that Protofire has developed for the ecosystem

- A grant from Balancer in 2022 to understand users’ and institutional investors' fears and demands. Protofire did a comprehensive survey including interviews and reports to drive Balancer’s strategy

- In 2023 Aave gave Protofire two Grants to develop a Credit Delegate Marketplace to increase the yields of their users while unlocking completely new use cases, using Atomica to make the process peer to pool

- A grant from Web3 Foundation in 2023 to create an Open Zeppelin-like smart contracts factory for the Polkadot ecosystem

- Multiple Grants from Chainlink to help with new network integrations, and create plug-ins for products such as Hardhat and Foundry

Protofire has already been working for some time contributing to the QuickSwap ecosystem with audits for its partners, such as Roe Finance and Giddy.

For more information about Protofire projects, visit their page https://protofire.io/projects. There you will find in-depth explanations about other projects they develop besides the grants mentioned above, which will include clients such as Gnosis Safe, The Graph, MakerDAO, 0x, Filecoin, Cowswap, and many more.

TL;DR:

- Protofire, a Service DAO, and Atomica, an algorithmic protocol, are proposing a grant to build a Staking Protection solution for QuickPerps

- The proposal is to transfer $15,380.00 from the QuickSwap DAO treasury to Atomica / Protofire to fund this operation on QuickPerps and feature Protofire on the QuickSwap website

- A governance discussion will first take place on the official QuickSwap Discord & Reddit and will run until Saturday, August 5 at 12:00 PM UTC

- Once the Discord & Reddit discussions conclude, a formal Snapshot vote will begin and run from Saturday, August 5 at 12:00 PM UTC until Wednesday, August 9 at 12:00 PM UTC

- Once you’ve read this entire blog post, make sure to visit the official QuickSwap Discord server & Reddit discussion forum to share your perspective with your fellow community members

Motivation

Surveys of large liquidity providers and depositors in major DeFi protocols such as Balancer conducted by Protofire, showed that most LPs will increase their deposits by 2-10x given that their risk concerns are addressed in the form of Risk Mitigation and Insurance (Risk Transfer) solutions.

A comprehensive Insured Deposits product for DeFi is still a complex and not fully addressed goal in the Web3 space. The risks involved that must be covered are diverse: front-end, the infrastructure of the dApp, smart contracts, oracles, necessary integrations, and finally the underlying assets (tokens) involved.

A truly comprehensive protection that does not deceive users requires the purchase of multiple protections combined, which can be triggered individually. Therefore, the total cost of such cover is still very high. An example: to set up a USDC/USDT deposit protection for a Beefy pool using the insurance platforms available on Web3 would cost (as of May 11th, 2023) 9.21% per year (Beefy protocol risk: 3.06% per year; USDC depeg risk: 5.19% per year; USDT depeg risk 0.96% per year).

Scope of Work

Milestone 1 - Waitlist Activation:

Protofire will provide an embeddable widget to be added to the Liquidity tab of QuickPerps, so they can test and gauge Liquidity Providers’ demand for protection. A drop-down menu will allow users to sign up for a waitlist to get protections like:

- Smart contract hack risk and Oracle attack

- zkEVM availability & zkEVM bridge risk

- Stablecoin depeg risk (USDC, USDT, DAI) causing QLP value loss

-

Users could secure their spot on a waitlist using email or a Telegram bot - the team intends to test different annual costs (A/B test) to also have a signal on premium costs.

Milestone 2 - Protection for QuickPerp QLP Stakers:

Protofire will develop and deploy a QLP Staking Protection feature for QuickPerps Liquidity Providers with the following tiers of protection:

- Up to $100K insurance for new Liquidity Providers who stake their QLP to attract new LPs, predominantly institutional. Free protections may include principal losses caused by:

- Smart Contracts hack, bugs, or economic design flaws

- Oracle manipulation attacks

- Depeg of QLP underlying stablecoins (USDC, USDT, and DAI)

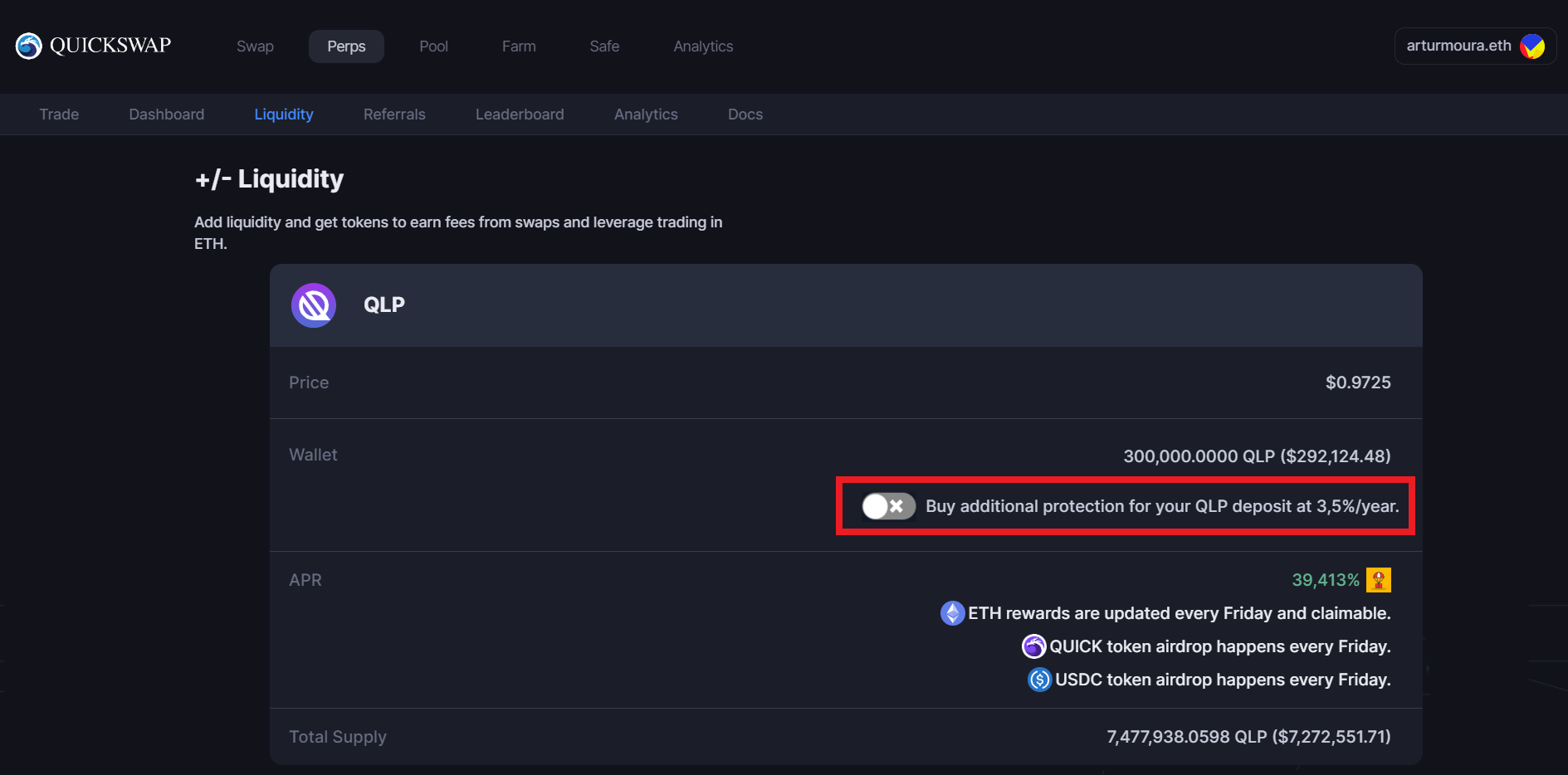

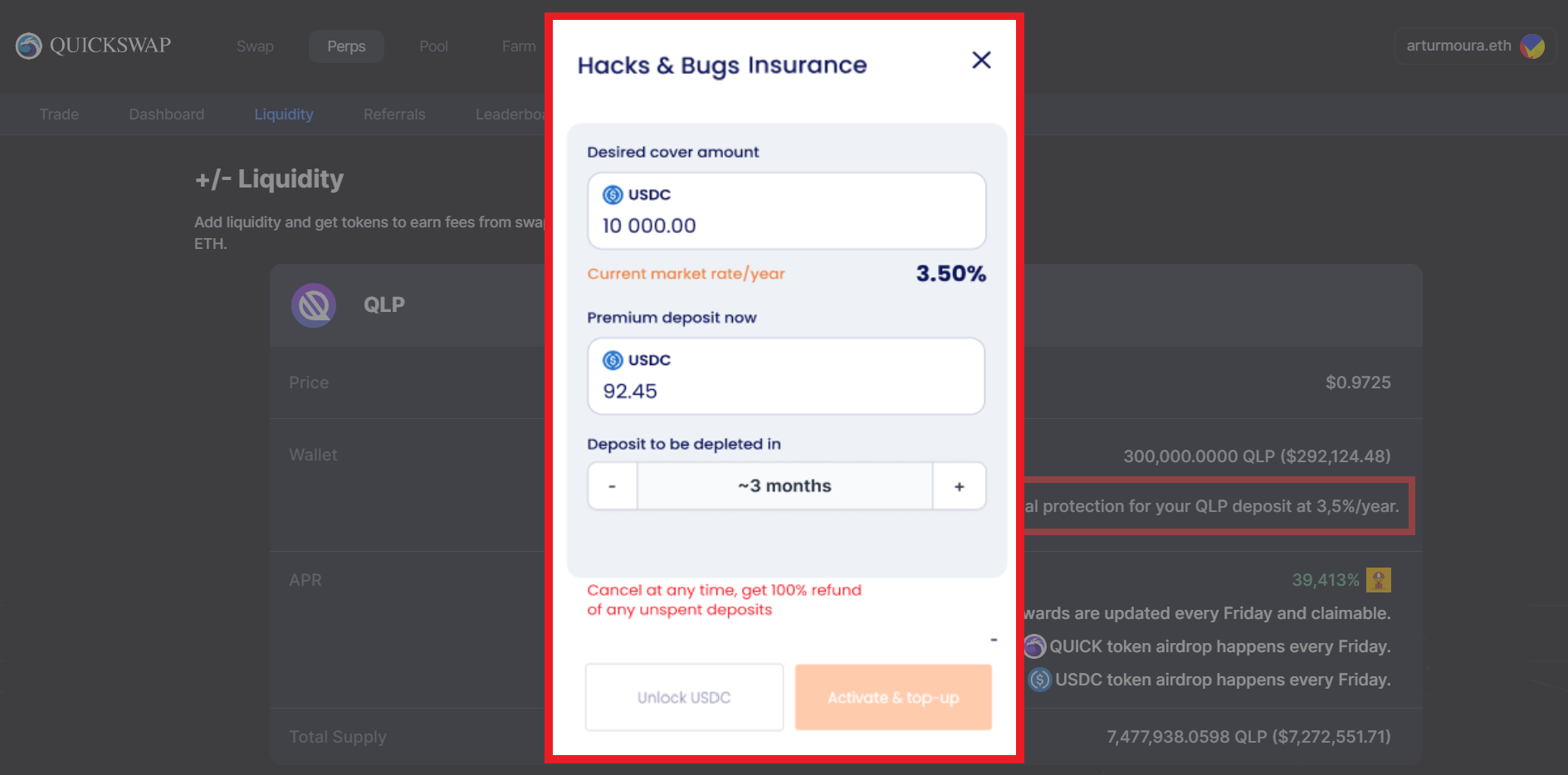

Milestone 3 - QLP stakers can activate optional insurance protection at market rate

Additional protection for Premium QLP stakers who want to upgrade their protection could be purchased directly on QuickPerps UI, with low friction. Those protections may include principal losses:

- Smart contracts hack, bugs, or economic design flaws

- QuickPerps frontend and Web2 infrastructure

- Oracle manipulation attacks separate per solution (Pyth, API3, In-house Oracle)

- Global depeg or deep impermanent loss of QLP underlying assets (ETH, BTC, MATIC, USDC, USDT, DAI)

- Governance attacks, the listing of new assets on the QLP basket

- zkEVM-related risks (bridge contracts, vulnerabilities, unavailabilities)

Milestone 4: QuickSwap Safety Module

3. Protofire will develop and deploy a QuickSwap Safety Module, similar to the Aave Safety Module, where external underwriters will be able to add liquidity for the different risks involved and get different APYs by doing that - QuickSwap and Protofire will jointly market these pools.

4. Users will be able to deposit QUICK, QUICK/MATIC LP tokens, and stablecoins to protect the protocol and earn yield. By deploying on leveraged pools covering multiple risk markets, APY could be 60%+.

5. The premium cost of protection could be deducted from the yields of QLP staking and also paid with revenue coming from the premiums of additional cover purchased by large LPs.

-

Cost & Timeline

QuickSwap’s investment (final price) will be $15,380. This price covers the following features:

- Perform a survey to gauge and test the Liquidity Provider’s demand for protection using the “Liquidity” tab on QuickPerps

- Set up and deploy a protection product and create a policy wording that will describe when the user will get paid in case of a hack, bug, depeg, etc.

- Setup and deploy of up to 10 (ten) risk markets: QuickPerps smart contracts, Oracle risks, stablecoin depeg

- Setup of 3 (three) liquidity pools per market (junior, mid, and senior) and 1 (one) reinsurance pool

- Integration with QuickPerps app for deposits to check available and active coverage using the Atomica widget

- Create a webpage to attract additional liquidity (Safety Module)

- Raise capital to bootstrap liquidity on 2nd loss pools along with QuickSwap

Safety Module Revenue Model

- QuickSwap treasury will receive 10% of the revenue from premiums

- Protofire will receive 10% of the revenue from premiums

- 10% of the revenue will be invested in risk mitigation projects for QuickPerps such as audits, monitoring, etc.

- 70% of Premiums go to Safety Module stakers who earn these premiums as real-time yield on the staked QUICK and all forms of QUICK derivatives

- For example: ERC-20 QUICK/MATIC Gamma pool tokens, MATIC, LSDs like stETH, WBTC - any token listed as collateral in a Safety Module - just as some AAVE token holders earn yield from staking bare AAVE and Balancer pool tokens such as AAVE/ETH LP tokens into an Aave Safety Module

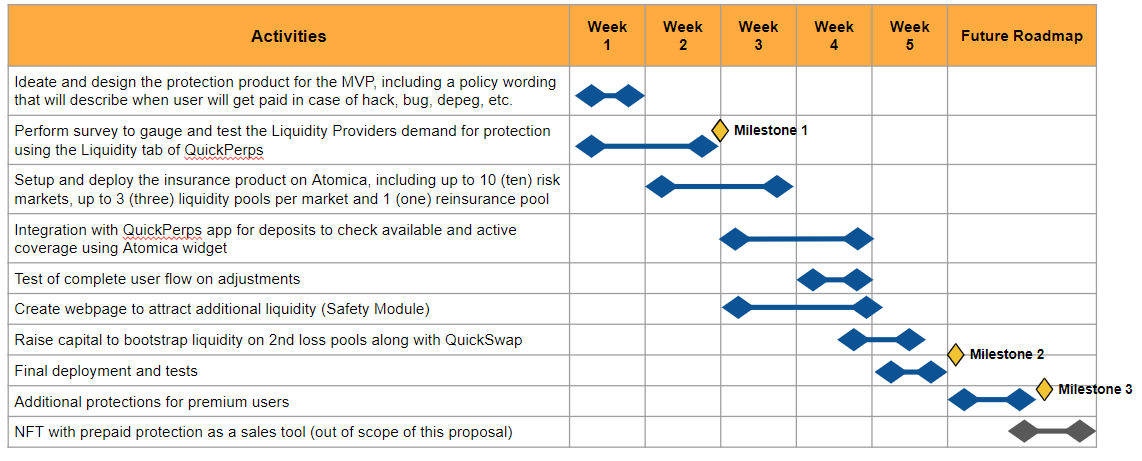

Timeline

Protofire/Atomica estimates the development time of Milestones 1 and 2 to take 5-6 weeks from approval. Milestone 3 development time will depend on which and how many additional protections for premium users the QuickSwap DAO will want to create. The high-level activities that will be executed to develop Milestones 1 and 2 are:

- Ideate and design the protection product for the MVP, including policy wording that will describe when the user will get paid in case of a hack, bug, depeg, etc.

- Perform a survey to gauge and test the Liquidity Provider’s demand for protection using the Liquidity tab of QuickPerps

- Set up and deploy the insurance product on Atomica, including up to 10 (ten) risk markets, up to 3 (three) liquidity pools per market, and 1 (one) reinsurance pool

- Integration with QuickPerps app for deposits to check available and active coverage using the Atomica widget

- Test of complete user flow on adjustments

- Create a webpage to attract additional liquidity (Safety Module)

- Raise capital to bootstrap liquidity on 2nd loss pools along with QuickSwap

- Final deployment and tests