What is impermanent loss (IL)? Can you prevent IL on QuickSwap’s V3? The IL topic gets a bit more complicated when discussing the concentrated liquidity model on QuickSwap’s V3. But we’re here to help you understand how it works and hopefully figure out what you can do to avoid IL.

What is QuickSwap V3?

We introduced our V3 ‘concentrated liquidity’ model in June 2022. QuickSwap’s V3 allows liquidity providers to allocate capital at specific price ranges for each trading pair. As long as the price of the pair remains within the range, the liquidity provider receives rewards proportional to the volume and liquidity that they allocated.

To understand how the V3 model works on QuickSwap, please read QuickSwap’s V3 guide.

While the profitability of the concentrated liquidity model has been proven, the risk of impermanent loss (IL) remains an important topic. LPs should factor in the IL when developing a strategy for their positions. Since many LPs want to make the most out of their crypto, they are attracted to providing for smaller ranges. A smaller range will result in greater liquidity concentration and higher rewards, but it also carries more risk. One of these risks is Impermanent Loss (IL).

What is Impermanent Loss (IL)?

LPs should already be familiar with the concept of IL from QuickSwap’s V2. Simply put, it refers to the loss you may suffer from providing liquidity instead of simply holding the two assets in your wallet. Here’s a more detailed explanation of how IL works on QuickSwap’s V2.

But in the case of V3, things are a bit more complicated, given the nature of concentrated liquidity.

To understand the IL risk, let’s take a brief look at the LP process on QuickSwap’s V3.

Providing liquidity on V3

To provide liquidity on V3, you must select the V3 pools and select your pair to supply. Because IL happens less to stable pair LPs, we will look at a non-stable pair. For this example, we chose QUICK and ETH.

The thing is:the higher the risk you take when choosing the range, the higher the rewards.

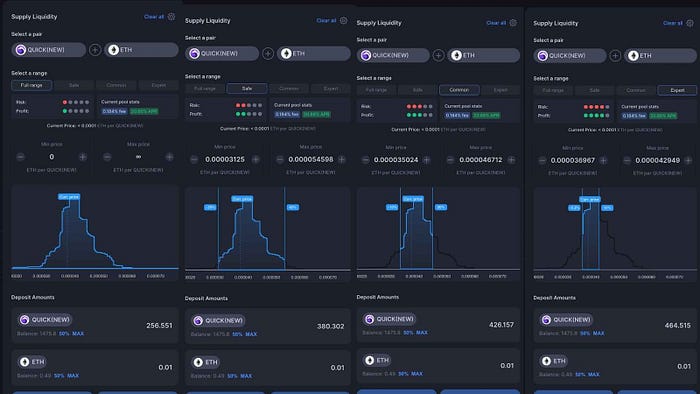

Of course, you may choose your preferred range (full range, safe, common, and expert) and even manually input the range.

Here’s the difference when choosing different ranges:

- Full range — the liquidity is used for the entire range. When choosing “Full range” on V3, your LP will be similar to LPing for V2, but instead of earning a share of the flat 0.3% fee the V2 DEX charges, you will earn a share of the variable 0.1–1% fee the V3 DEX charges — depending on the assets’ volatility.

- Safe — the price must stay between -20% and +40% of the current price to remain within range and earn rewards.

- Common — the price must stay between -10% and +20% of the current price to remain within the range and earn rewards.

- Expert — the price must stay between -5.2% and +10% of the current price to remain within the range and earn rewards.

This image shows how the price range changes when you select these different options.

To avoid IL, the prices should stay the same. That’s the ideal case, but it’s impossible with crypto. And that’s why many choose LPs for stablecoin pairs.

The 2 Cases of Impermanent Loss on V3:

- The price goes out of the range

- The price varies but remains within the range

V3 IL Type 1: Price goes out of range

When the price of the assets you’ve LPed for goes out of range, you stop earning trading fees and liquidity mining rewards. The smart contract converts your entire liquidity position to the least valuable asset in the pair.

In this case, you can calculate your impermanent loss by looking at your liquidity.

- What’s the value of your remaining asset?

- Plus any earned fees and/or rewards

- Then calculate the initial value of the two assets you deposited at their current prices

- (a+b)-c = your IL

V3 IL Type 2: Price moves but remains within the range

The other more common case of V3 IL is when the price moves but stays within the range.

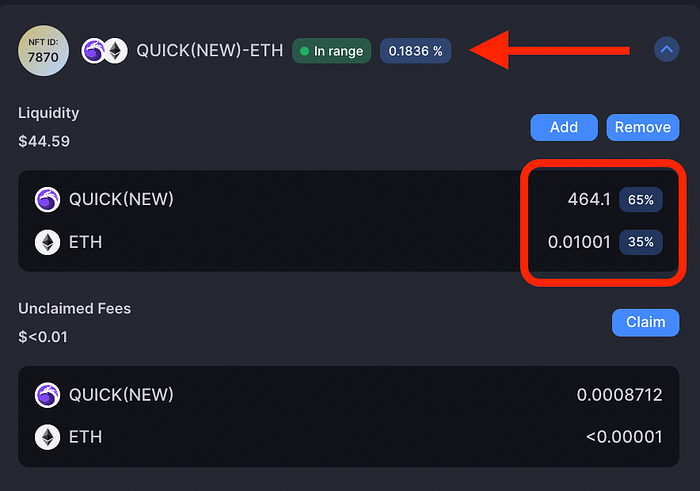

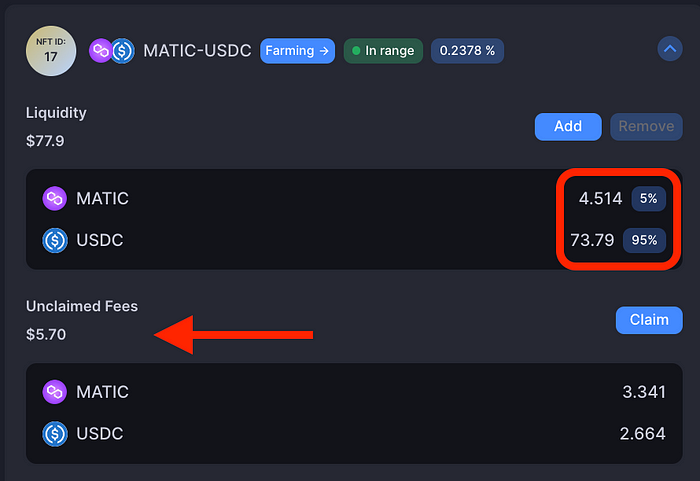

On QuickSwap’s V3, you can see which LP is “In range” by looking at the displayed tags next to the pair’s name.

Under “Liquidity” you can see the percentage of each asset. At first, this percentage varies according to your chosen range. However, over time, when prices change, the pool will automatically convert a percentage of your LP to match the current price. It does that until the price eventually falls out of range. This means that some IL always applies to your LPs.

The only way to overcome IL is to earn more in fees than you lose through IL.

The earnings from your LPs are represented by the received fees (see value under “Unclaimed Fees”). Again, the fees are not fixed and you receive fees only when someone uses the pool for swapping.

When the percentage of the assets deposited changes, then you have to calculate the new position value, which is more complicated than the formula (x*y=k) used for IL in V2.

Just to give you an idea, this should look something like:

LP value = (Token1 quantity x Token1 Price ) + (Token2 Quantity x Token2 Price) + Fees Earned

The formula for fees earned can be calculated as:

Fees earned = days held x simple fee estimate

To estimate the IL, you should also calculate the value of the assets if you had just held them.

HODL value = (Token1 quantity x Token1 price) + (Token2 quantity x Token2 price)

To calculate the gains (or losses) of your LP:

LP value — HODL value

This image shows how the percentage changed.

Since the calculations are more complex, we are developing better analytics tools for our V3 LPs and working with concentrated liquidity managers to help you better manage your liquidity positions.